The Subsea Shake-Up That’s Rewriting Cost Reality

Deepwater projects have long been synonymous with high risk, high reward but this balance is rapidly changing. With oil price volatility, supply chain disruptions, and escalating material and logistics costs, the economics of subsea development are facing renewed scrutiny. The conventional cost-cutting playbook that is squeezing suppliers, optimizing procurement, or delaying projects is no longer sufficient to restore competitiveness.

But the tides have turned. Today, the challenge beneath the surface is no longer about how deep we can drill, but how economically we can deliver. Across global basins, operators and EPCs are confronting the same challenge: how to deliver complex subsea systems faster, cheaper, and with greater reliability, without compromising safety and performance.

Key findings in the 2025 outlooks from Offshore Engineer and corroborating analyst publications indicate the following:

- Subsea and offshore project costs have climbed by nearly 20% between 2022 and 2025, largely due to inflation in materials, labor, and logistics.

- Vessel day rates have increased by more than 30% in this period, reflecting a tightening supply-demand balance and high utilization rates across the offshore sector.

- Equipment lead times for key subsea systems have stretched by several months, impacting construction schedules and contributing to project uncertainty.

- As a result, many projects that once promised robust returns are facing delays, revaluation, or postponement not because of a loss in industry capability, but due to a global reset of baseline project costs and risk factors.

The new question every operator is asking is simple: how can we make subsea work again and not as an engineering feat, but as a competitive business model?

From Fragmented Systems to Integrated Thinking

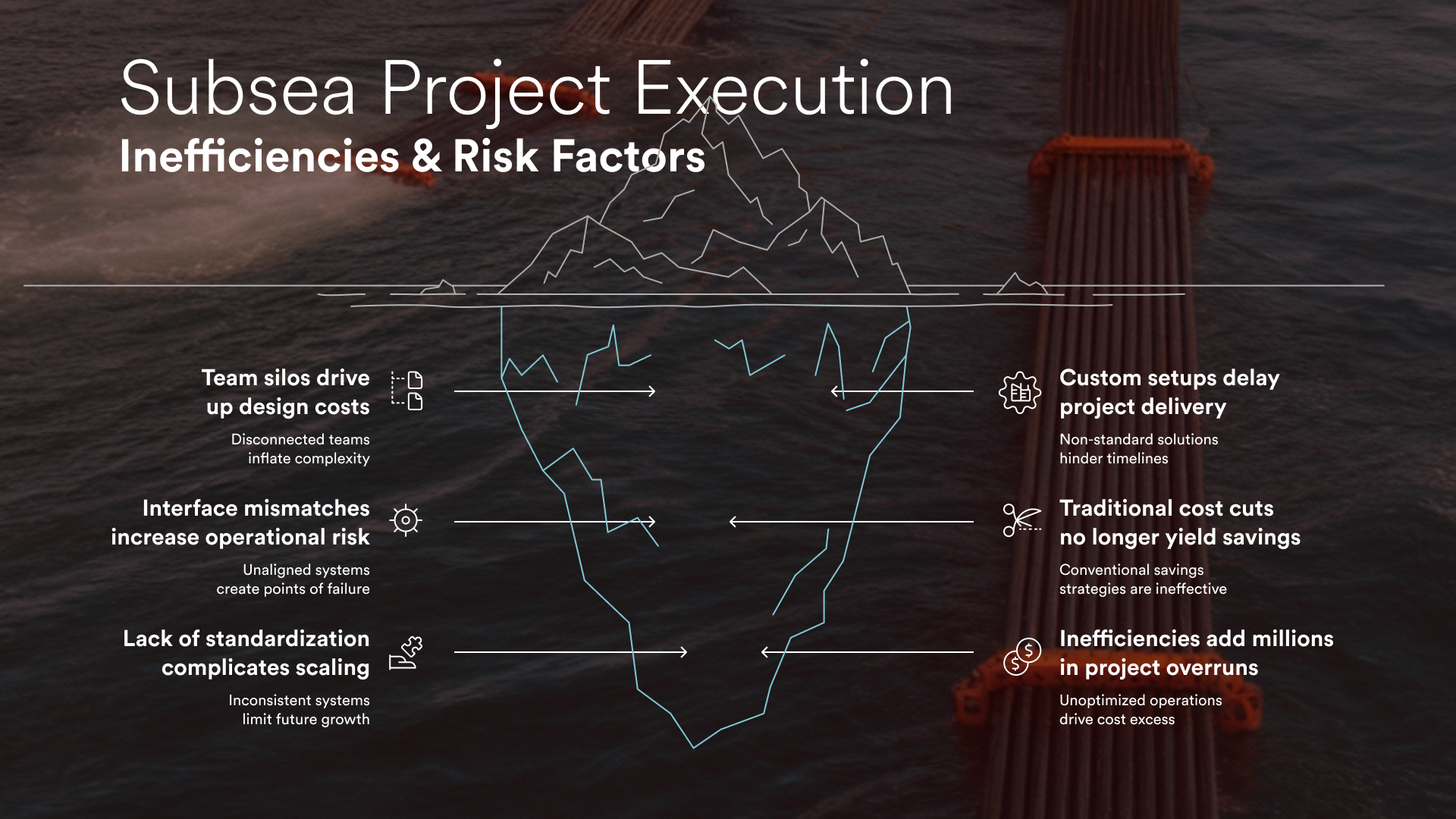

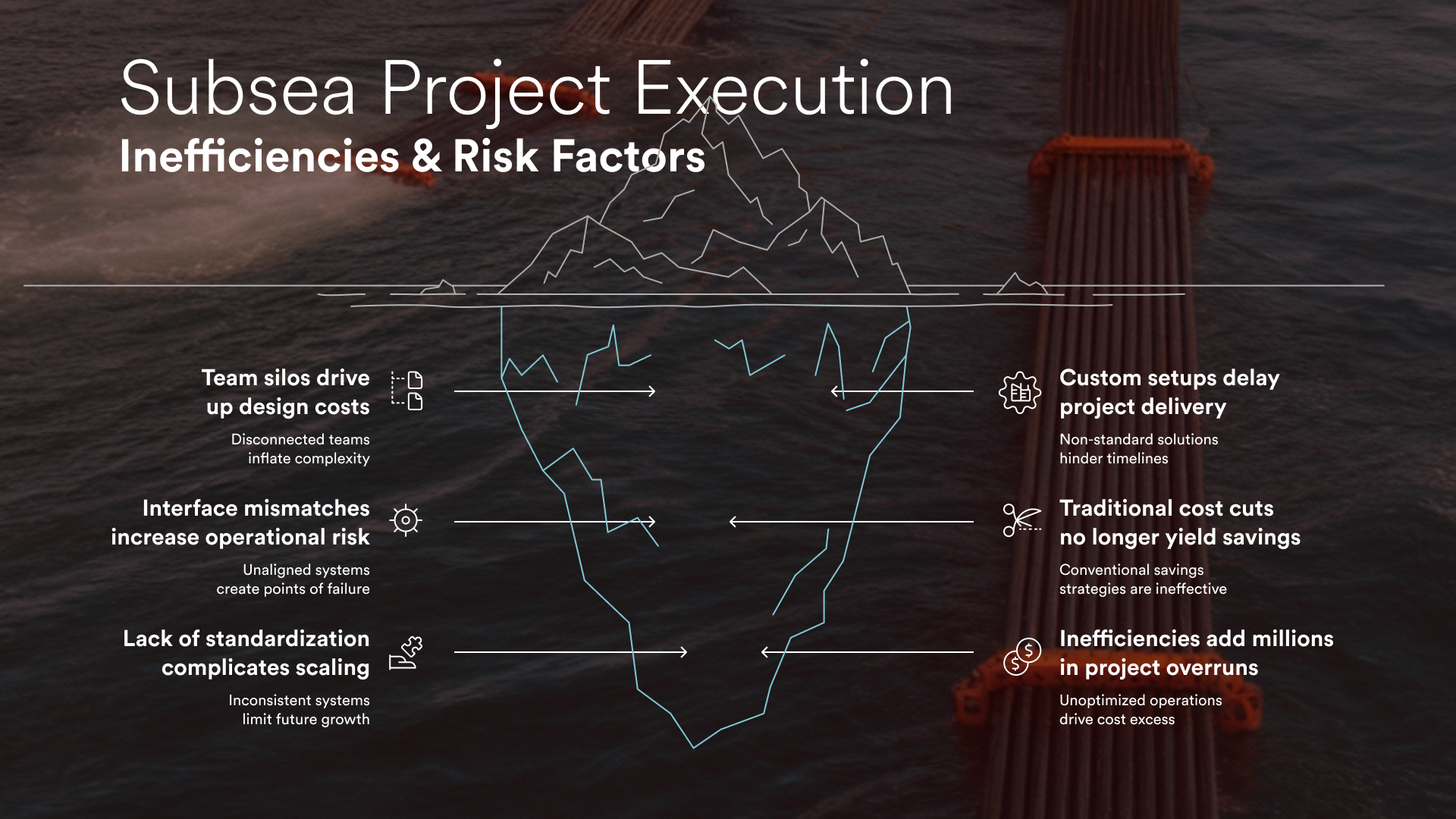

Traditional levers are losing their pull. Squeezing suppliers, renegotiating procurement, or delaying investment no longer delivers meaningful gains. The real challenge lies deeper, and in the way subsea systems are designed and managed.

Fragmentation between Subsea Production Systems and SURF teams still inflates design hours. Custom configurations extend qualification and slow readiness. Inconsistency across interfaces adds risk, cost, and delay. Rystad’s 2024 review estimated that these inefficiencies can add several million dollars per well in overruns. The solution isn’t marginal adjustment rather it’s structural integration.

Across global basins, a new way of working is taking shape. Standardization, modularity, and digitalization are no longer buzzwords. Together, they form the foundation of the next chapter in subsea competitiveness.

- Standardization: Building Predictability Through Reuse

Equinor’s use of standardized subsea templates in the Norwegian Continental Shelf has shown how design reuse shortens project timelines and lowers tie-back costs. Standardization is replacing reinvention. It allows suppliers to collaborate on shared specifications and create interoperability across systems. The result is predictable quality, faster qualification, and stronger reliability.

- Modularity: Designing for Agility and Scale

Modularity is enabling a new rhythm of investment. Total Energies’ “Subsea Factory” in West Africa streamlined fabrication through pre-qualified modules, enabling phased development that adapts to market and reservoir conditions. Modular architecture gives operators flexibility and the freedom to align CAPEX with opportunity instead of locking it in early.

- Digitalization: Turning Data into Design Intelligence

Digitalization is closing the loop between design and operations. ExxonMobil’s Kaombo project in Angola used simulation and digital twins to identify installation challenges early and reduce commissioning rework. Across the industry, digital twins are no longer experiments but are gradually becoming the backbone of design strategy.

Studies across major offshore programs show that early integration of digital twins can reduce lifecycle costs by up to 20 percent while improving operational efficiency. The logic is simple: better insight during design prevents costly surprises later. Brazil’s pre-salt Lula field proved how digitally informed design can redefine value, using subsea separation to lower energy demand and extend productivity.

Case in Focus |Cost Reduction for Offshore HVDC/HVAC Cables

|

Faced with supply chain disruption and the challenge of scaling offshore electrification, a global oil and gas major teamed with FutureBridge to target early-stage innovations in subsea HVDC/HVAC cable systems. Our partnership delivered actionable, techno-commercial insights prioritizing cost-saving cable technologies and reliable suppliers. By assessing root causes of cable failures, comparing component-level solutions, and evaluating impact on CAPEX/OPEX, our experts helped map a direct path to reduce project costs while enabling fast, resilient offshore connectivity. Read the full case insights here |

|

A New Equation of Value

Competitiveness in subsea is no longer measured by cost per wellhead. It is measured by value across the lifecycle. Standardization creates scale. Modularity creates adaptability. Digitalization creates foresight. Together, they define a new kind of resilience. Integrated systems lower cost volatility, improve supply reliability, and align project economics with sustainability objectives. This balance of cost, capability, and carbon balance is now the true currency of competitiveness. An infographic from the FutureBridge Industrial Equipment Business Unit illustrates how new approaches in subsea design and digital integration are improving cost efficiency and reliability across deepwater projects. View it here.

By 2030, subsea competitiveness will be defined by integration. Operators that connect design, data, and delivery will achieve lower lifecycle costs, faster execution, and measurable sustainability gains. Those that continue to optimize in isolation will struggle to keep pace with shifting market economics. Hardware innovation will still matter, but systems thinking will matter more. The ability to align engineering with digital intelligence and cross-domain collaboration will decide who leads the next decade of deepwater investment. FutureBridge has analyzed these dynamics in its webinar, Beyond the Price Tag: Is Your Subsea Strategy Cost-Competitive where the session discusses shared evidence from current industry programs and explores how integrated design approaches are reshaping subsea economics and project viability.

The subsea sector is entering a decade defined by integration, electrification, and digital intelligence. Our analysis shows that standardized modular architectures, AI-enabled asset management, and subsea electrification are reshaping total cost of ownership across deepwater portfolios. By 2030, more than 60% of new subsea projects are expected to embed digital twins and remote operations, enabling up to 25–30% OPEX reduction and measurable CO₂ intensity gains. The next horizon of value lies not in incremental cost control, but in integrated value chains, where design, data, and delivery are synchronized to drive sustainable competitiveness and investor resilience.

To get your offshore HVDC/HVAC cable strategy on the fast track to results, contact our experts and identify cost-saving innovations, evaluate technology options, and more