Introduction

Since the last few years, city dwellers across Asia, North America, and Europe have witnessed ubiquitous growth of two-wheel micro-mobility in the form of shared electric bikes, scooters, and motorbikes.

Consumers prefer Micro-mobility as it is easy to use and provides a convenient combination of electric traction and dockless operation. The adaption of micro-mobility is on the rise as consumers can seamlessly use a two-wheel vehicle via a smartphone app against using traditional transport systems such as a car, bus, or train that is dependent on road-traffic.

The congestion in the city areas is on the rise. It is increasing the time loss of passengers, according to the 2019 INRIX National Traffic Scorecard, Americans have lost an average of 99 hours a year due to traffic congestion. In the same year, traffic congestions have cost Americans roughly $88B, or an average of almost $1,400 per driver.

Also, micro-mobility has a positive impact on air pollution, for which cities across the world have been struggling. Micro-mobility startups offering emission-free two-wheel vehicles are emerging as an effective alternative to the current public and private transit mix – primarily during the current COVID-19 crisis.

Since the past few months, the COVID-19 pandemic has disrupted the micro-mobility industry, notably during the complete lockdown phase.

However, it is expected that micro-mobility startups will be back to growth during unlock-down as people will resurface to opt for single-rider, open-air transit vehicles to maintain social distancing and have minimum shared points of contact.

Apart from the COVID-19 pandemic, the global population is expected to reach 8.5 billion by 2030, with 60% of people living in cities, accounting for 70% of global emissions. This increase in the urban population will cause an exponential increase in congestion, with a major contribution from traditional transport vehicles such as a car, bus, or train. Micro-mobility can be a cost-effective answer to this, along with some other issues such as increasing global population and environmental concerns.

On the other side, there are certainly some challenges for micro-mobility, such as lack of regulations, citywide bans, and theft. However, this concept has the potential to disrupt the mobility sector globally massively.

A growing market of Micro-mobility

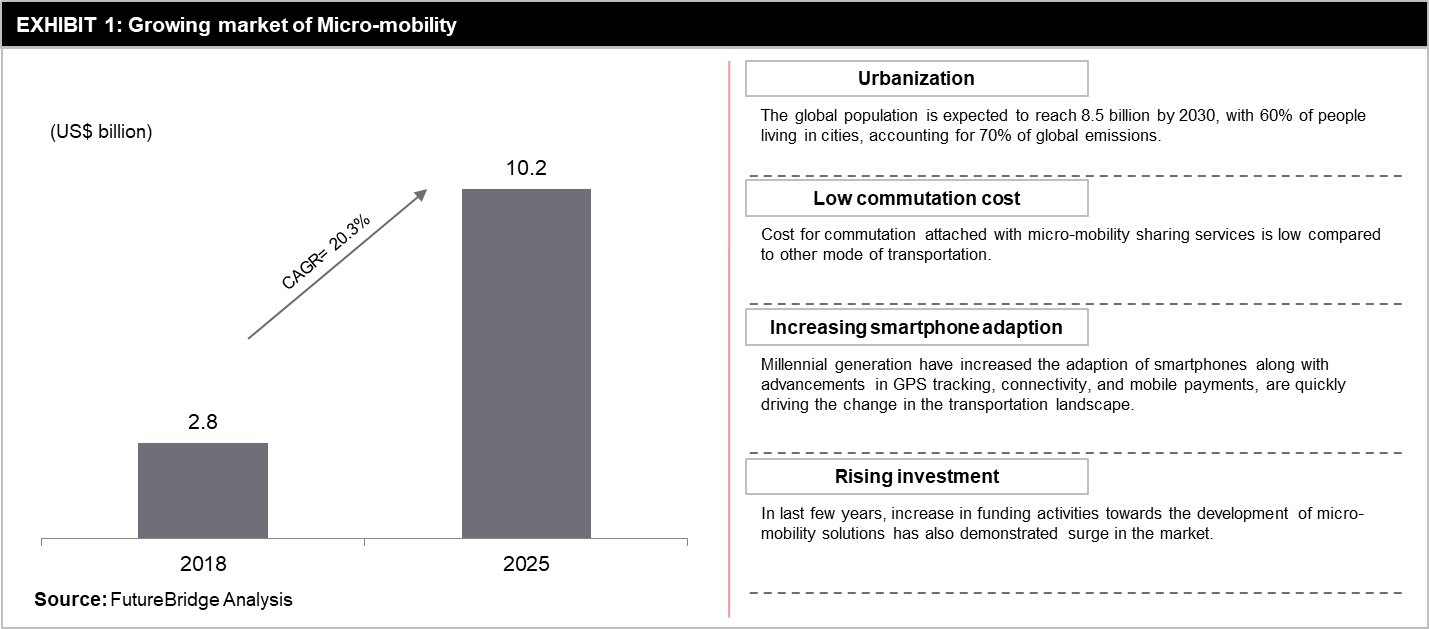

The market demand for micro-mobility is poised for significant growth in the next 5–7 years. The market is expected to grow at a 20.3% CAGR from 2018, to reach $10.2 billion in 2025. Following are the various factors that are driving its demand:

- Urbanization: As per the WEF report, the global population is expected to reach 8.5 billion by 2030, with 60% of people living in cities, accounting for 70% of global emissions.

- Lower commutation cost: Cost for commutation attached to micro-mobility sharing services is very low compared to another mode of transportation. For example, a typical revenue structure of bicycle-sharing services includes an initial cost of $0.5 and an additional $0.5 per 30 minutes, which is much less than other public sharing options, such as taxi or other vehicle services.

- Increasing smartphone adaption: Millennial generation has increased the adaption of smartphones along with advancements in GPS tracking, connectivity, and mobile payments, which are quickly driving the change in the transportation landscape.

- Rising investment: In the last few years, an increase in funding activities towards the development of micro-mobility solutions has also demonstrated a surge in the market. For instance, in 2018, $50 million investment was raised by VOI Technology AB, a Swedish kick scooter sharing company from London-based venture capital firm, Balderton Capital. Similarly, in 2019, Indian motorcycle manufacturer Bajaj Auto backed Yulu in its $8M Series A round and signed a strategic partnership with the startup to design

Rising micro-mobility adoption in Asia and North America

In the past few years, micro-mobility service has been introduced in all geographies globally, out of which, Asia and North America regions have witnessed significant growth in adoption.

In Asia, China is a leader in bike-sharing

In Asia, half of all 4.5 billion citizens live in urban areas. As the continent’s cities are expanding at an unprecedented rate, it is a prominent challenge for developers to control road congestion and air pollution.

In the coming years, sustainable urbanization will be a major area, wherein, city dwellers will be a key part of the puzzle. In this scenario, micro-mobility vehicles such as e-scooters, e-bikes, and bikes are demonstrating a great promise in shrinking the physical footprint required to move people short distances.

In the micro-mobility industry, Asia has been leading. Wherein, China pioneered to implement a dockless bike-sharing platform in 2015. Compared to Europe and North America, micro-mobility companies have to go through less regulatory red tape, giving the advantage of quick implementation across cities in Asia. However, lack of regulation has resulted in an over-saturated market with millions of single-rider vehicles piling up in city streets.

Yet, considering increasing urban pollution levels and ultra-congested streets, it makes sense that cities like Beijing and Shanghai are reducing automotive transportation and make the switch to emission-free solutions.

Apart from China, other Asian countries such as Singapore, Taiwan, and South Korea are also witnessing growth within the micro-mobility market.

Micro-mobility startups in China

Chinese cities have taken efforts to reduce mobility issues by introducing docked bike-sharing municipal programs. The program was initially launched in the year 2008 by Hangzhou Public Transport Corporation, following which various other cities such as Beijing, Shanghai, Wenzhou, Kunming, and Guangzhou also set up public bike-sharing programs.

In recent years, as private companies have emerged by offering the dockless facility, the use of public bike-sharing has decreased.

On the other side, private companies have been receiving heavy investments to expand globally. For instance, Ofo, founded in 2014, had unicorn status and managed to deploy 10 million bikes across the US, the UK, Singapore, Australia, France, and among others. However, by 2018, Ofo stopped its international expansion as it struggled to manage high operational costs and fight competition. Currently, Ofo is focusing on its home country-China.

Similar to Ofo, Mobike, founded in 2015, saw growth during initial years and expanded internationally, and turned unprofitable. In 2018, Chinese meal delivery Meituan Dianping acquired Mobike for $2.7B and rebranded the Mobike to Meituan Bike.

In 2018, Didi Chuxing, China’s largest ride-hailing service, acquired Bluegogo, a bankrupt bike-sharing startup to expand its bike-sharing business. In April 2020, SoftBank and Legend Capital invested $150M to Didi Chuxing bike sharing segment and following to which, in June, Didi announced that they had reached 10M daily orders for the same segment.

India: An emerging micro-mobility market

Various micro-mobility startups in India are emerging with two-wheeler vehicle sharing solutions to address various problems such as poor road infrastructure, congested roadways, and rising air pollution.

Founded in 2014, Bengaluru based startup, Bounce operates its micro-mobility business with more than 20,000 electric and gasoline dockless motor scooters. This year, in January, Bounce secured a funding of $105M at a $500M valuation.

In the area of e-bike sharing, Vogo and Yulu are competing with each other. Vogo is backed by Ola, a ride-hailing giant. In late 2018, Ola infused $100M to enable Vogo to expand its fleets. Similarly, Yulu is also backed by motorcycle manufacturer Bajaj Auto. In late 2019, Baja Auto backed Yulu in its $8M Series A round and signed a strategic partnership with the startup to design and manufacture its e-bike.

North America witnessed a shift towards scooters

The US has pioneered to introduce dockless electric kick scooters, wherein, Bird, a micro-mobility startup, deployed hundreds of its kick scooters in September 2017 for California state.

Irrespective of regulatory problems, slowly after Bird’s initiative, dockless scooters were in demand. Based on this, several US-based scooter-sharing companies gained unicorn status quickly as big investors poured millions of dollars into the new space until COVID-19 hampered the growth.

Apart from scooters, since 2009 shared bike programs have existed in various cities across North America, but have remained less popular than e-scooters.

Since 2018 there has been a shift in consumer preference, wherein, e-scooters overtook shared bikes as the method of dockless transportation. At present in cities, dockless bikes are reducing day by day. For example, Lime has scrapped tens of thousands of Jump’s bikes that were transferred by Uber in May 2020 as a part of a larger investment.

Apart from micro-mobility startups, North America’s largest ride-hailing companies have entered into the micro-mobility market intending to have all forms of transportation into their portfolio offering.

In 2018, Lyft acquired a bike-sharing company Motivate, to become the largest bike-share service in North America. Lyft controls a majority of the US’s bike-share programs that include Citi Bike in New York, Ford GoBike in San Francisco, Divvy in Chicago, Bluebikes in Boston, and among others.

Apart from scooters and bikes, electric mopeds have also received traction in the US. Revel, New York-based company, launched in its shared services 2018 and has received funding of $28M in October 2019. Revel is planning to expand its shared services to Austin, Washington DC, Oakland, and, Miami.

COVID-19 impact on the micro-mobility sector

COVID-19 pandemic has resulted in reduced demand for transportation as most of the countries are in a lockdown. Companies of the micro-mobility sector were already having a tough time becoming profitable, and after this pandemic, it has turned devastating for them.

Continuing operations in difficult times

Currently, micro-mobility companies are facing a challenge of reduced demand coupled with the increased contamination risks involved in using shared assets. To address this, companies are exploring ways to establish disinfection practices during redistribution and develop virus-inert materials when designing future models. Companies are also exploring solutions to provide support for essential workers.

In some cities of California, Gruv is providing free e-scooter rides to those on the front lines of pandemic response, which includes health-care and grocery-store workers. Similarly, in cities such as Boston, Chicago, and New York City Lyft is providing free bike-share access to people from health care and public transportation sector. Spin has launched a similar initiative in Baltimore, Los Angeles, Portland, and other cities.

Companies have stepped their efforts to clean and sanitize vehicles that would result in a reduction of contamination risk. Wheels, headquartered in California, has paused its shared bike service in several cities. However, it is having its pedal-less e-bikes with self-cleaning handlebars available to essential workers. Scooters by Spin now come with a hand sanitizer attached. Further, companies have started sanitizing their vehicles more often and also have their field staff with protective gloves.

Companies are already having these autonomous delivery robots serving in bounded premises such as corporate campuses, hospitals, and universities, however, there soon could be seen on city streets transporting paperwork, food, lab tests, and among others.

Post-COVID, the world of new normal will have delivery by autonomous vehicles at the workplace, public spaces, and city streets.

Post COVID-19

Most of the micro-mobility companies are expecting the market growth post-pandemic as people would prefer single-rider vehicle commutation against crowded public transport. The sector is already witnessing some revival signs: In South Korea, which has contained the virus and people are returning to normal life, Lime has reported a surge in scooter trips by 14% in comparison to trips before the pandemic. In China, Hellobike recorded 30% month-over-month growth for its bike trips.

Post pandemic, it can also be expected that the micro-mobility sector may shrink as startups will get acquired by big companies such as Uber, Didi Chixung, and Lyft. For instance, this month, Superpedestrian, a Boston-based mobility engineering, and technology company acquired Zagster, a bike-sharing startup company in Boston to expand its scooter fleet in the US.

Road to the future for micro-mobility success

Companies providing micro-mobility services using vehicles such as shared bikes, scooters, and motorbikes are facing multiple challenges that are impacting their financial health. Globally, companies are witnessing very high levels of theft and vandalism on the one hand, while they have to pay for high redistribution and charging costs on the other hand. Both of these challenges have aggravated by the dockless operation. Wherein, users can discard two-wheel vehicles anywhere, while making retrieving and redistributing vehicles cumbersome and expensive for owning company.

Following advanced technology solutions can be adopted to overcome these aggravated challenges:

- AI-based real-time location data analytics can be used for improving spatial intelligence and also, to gain an understanding of demand-response patterns to optimize redistribution and recharging efficiencies;

- Advanced telematics technologies can be deployed for cost-effective fleet and asset tracking management operations such as redistribution of vehicles and battery swapping practices;

- Advanced location tracking technologies to locate stolen vehicles based on Low-Power Wide-Area (LPWA) connectivity

In the long term, micro-mobility companies should have efficient management of their vehicles to reach profitability. Maintaining long-term profitability will organize the currently fragmented ecosystem into a limited number of global players. At the same time, to better serve the interest of people and the environment, it will be essential to integrate micro-mobility services with wider MaaS- Mobility-as-a-Service framework. This integration will effectuate the potential benefits of micro-mobility such as better accessibility to public transportation, reduction in road congestion, lowering environmental footprint, and provide convenient methods for a short trip.

Need a thought partner?

Share your focus area or question to engage with our Analysts through the Business Objectives service.

Submit My Business ObjectiveOur Clients

Our long-standing clients include some of the worlds leading brands and forward-thinking corporations.

- © 2021 Cheers Interactive (India) Private Limited. All rights reserved. FutureBridge ® is a registered trademark of Cheers Interactive (India) Private Limited.