Introduction

In recent years, the mobility sector has made significant progress in many dimensions such as autonomous driving, connectivity, electrification, and E-hailing. In 2019, electric vehicle sales recorded an all-time high globally, whereas, many players set new milestones by demonstrating fully autonomous cars without backup drivers. Similarly, in E-hailing space, leading players such as Uber and Lyft became publically listed companies during spring 2019.

E-hailing has become the most interesting area of development for mobility industry leaders, which can be seen by the amount of investment that is happening in this segment over the last 10 years. E-hailing reduces the dependence on privately owned cars or multiple transport apps by combining services from taxis, car rental, car sharing, and even public transport under a single platform that is accessible from a smartphone.

The world is getting increasingly urbanized, today, around 55% of the population leaving in urban areas, which is expected to increase by 68% by 2050. Because of this, road traffic woes have reached new heights for major cities around the world. E-hailing can be the answer to this, along with some other issues such as increasing global population and environmental concerns.

Accelerating investments and partnerships across the mobility industry

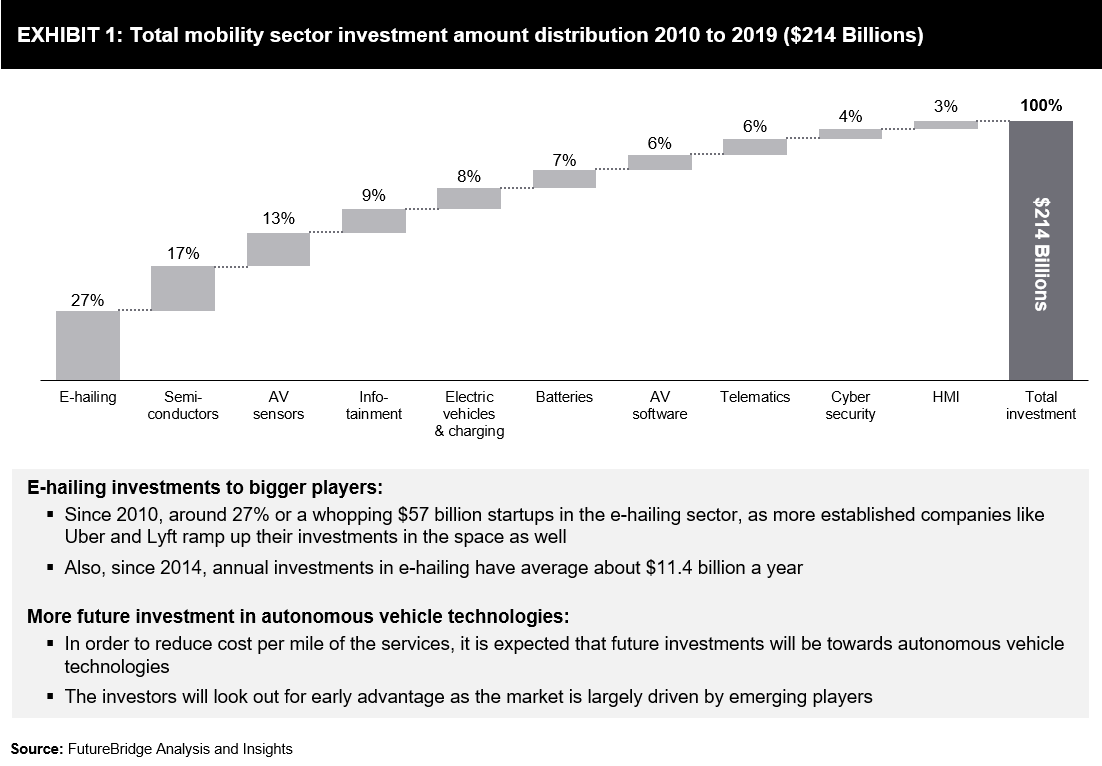

Across the mobility sector, there has been continuous investment across various technology clusters such as E-hailing, semiconductors, ADAS, and autonomous driving. Exhibit 1 below shows total investment in the mobility sector since 2010, where we can observe how E-hailing technologies appear to be the most promising cluster, as it has received the majority of the funding in the last ten years.

On the ecosystem side, in the last five years, there has been a transformation of the traditional automotive industry into a mobility ecosystem, wherein automakers are not anymore working on only hardware or components but most of the players are now also working on technology enablers. Automakers, which were traditionally sharing the financial burden to develop and manufacture parts like engine, are forming coalescence with government, suppliers, and technology enablers, to successfully build E-hailing services.

The exhibit below shows the sample list of automakers partnering with technology enablers such as self-driving technology companies, chip manufacturers, energy solution providers, ride-sharing services, etc., to develop the right mobility solutions. Exhibit 2 represents various partnerships that have taken place in the last 2 years to define the future of E-hailing, autonomous vehicles, and electrification.

Growing market and changing revenue segments

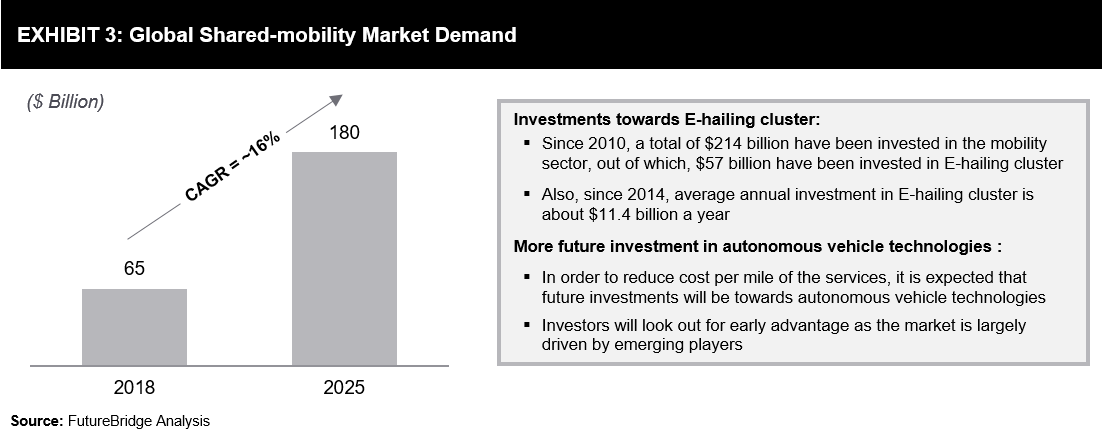

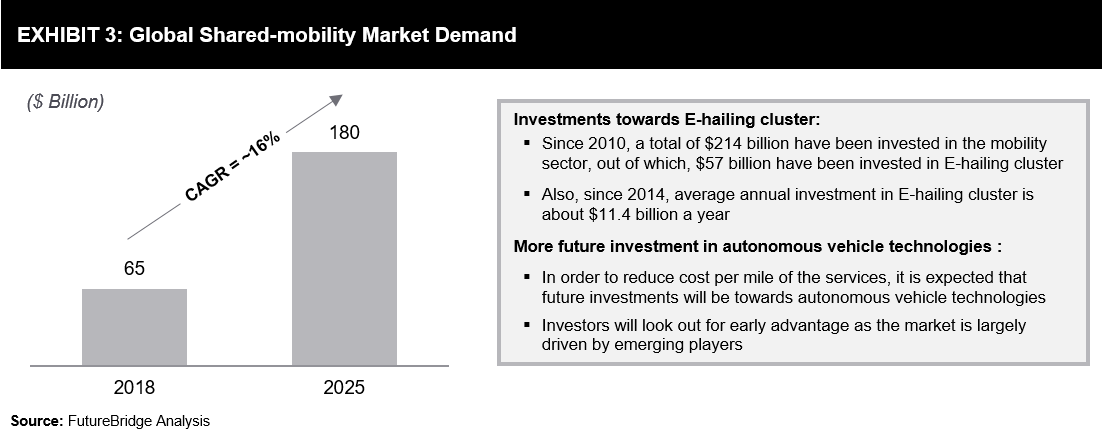

The market demand for shared mobility is poised for significant growth in the next 5–7 years. The market is expected to grow at a 16% CAGR from 2018, to reach $180 billion in 2025. This is a scenario that can be considered as least aggressive; however, with the increasing demand for self-driving taxis, the market can grow at a much higher rate >20% CAGR during the same period (refer Exhibit 3).

Increasing penetration of smartphones and connected vehicles has been a key factor that is escalating E-hailing market growth. Governments in the US and Europe are encouraging people to use shared mobility to solve issues regarding traffic and greenhouse emissions. Besides, the high cost of vehicle ownership is forcing people to opt for cost-effective transportation modes. Also, growing traffic on the roads, high fuel costs, and decreasing parking spaces are other factors that would further contribute to the growth of the shared mobility market in the coming years.

Factors that are restraining the growth of the E-hailing market are the reluctant nature of individuals toward sharing their vehicle with strangers and less knowledge about such type of service models. Also, low network infrastructure and poor internet connectivity are negatively impacting the E-hailing market, especially, in developing geographies.

At the commuter level, station-based mobility is a viable option, wherein scooters, bikes and other forms of personal transit offer to consumers – low prices, speeds in cities, and on-demand availability. This type of mobility is a major challenge for the E-hailing market.

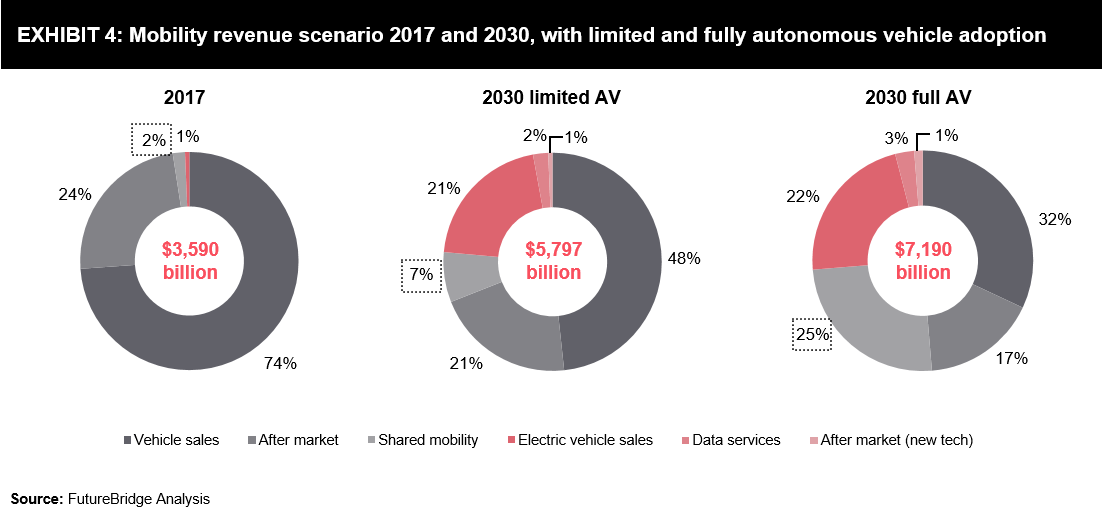

With the increasing penetration of autonomous vehicles, coupled with vehicle electrification, there is a high possibility to have a new slice of revenue from E-hailing services for the automakers. Exhibit 4 shows, the new revenue stream from E-hailing, which could sum up to $1.5 – $2.0 trillion in 2030, considering ride-sharing companies continue to make significant billion-dollar investments and start making profit each year.

Globally, Asia is the largest market for shared mobility. Within Asia, China and India will be the most promising markets due to the large population. China is already a leader in ride-sharing services with players like Uber and DiDi gaining a strong foothold in the country through joint ventures, collaborations, M&A’s, etc.

Robo-taxis: A key-enabler for E-hailing mass adoption

Autonomous vehicles in the form of robo-taxis would be disruptive, considering it will enable affordable mobility to people without driver’s licenses. However, it should be expected that this disruption could occur in different ways.

Robo-taxi adoption will differ from city to city, wherein each city having unique characteristics such as modal spilt, public transport penetration, efficiency, and wage levels of taxi drivers. Apart from these characters, adoption will also depend on the cost of car ownership, the cost of parking, local taxes, city tolls, and so on.

Spending for mobility today will define pricing for robo-taxi. It is expected that as technology costs reduce the price of robo-taxi and shuttle operators will level. This will attract more customers to robo-taxi operators. It can also be expected that local government authorities would not allow pricing to level or even undercut public-transport costs as they do not want consumers to avoid using public-transport offerings by transitioning to car-based mobility. This transition would be avoided as it would increase congestion and other urban problems.

On the other side, regulations will also play a major role in adoption. It is expected that in the coming years, regulations and standards will define the commercial road ahead for autonomous cars considering the safety of people is always a major priority of the government.

Road ahead

In the future, especially till 2030, the success of shared mobility would depend on customer adoption, the crafting of policies and regulations by governments across the world, and the development of enabling technologies. Industry players would offer cost-efficient alternatives to taxis and public transportation, wherein affordability and customer convenience would be primary factors to be considered. This shift could see rapid acceleration with the introduction of autonomous vehicles or robo-taxis and supportive initiatives by city/state administrations. This would enable E-hailing companies to offer new options for better customer experience and enhance service quality and revenue by providing purpose-built specialized vehicles.

The transformation of the traditional automotive sector to a mobility sector, with E-hailing being a major trend could bring real disruption in the market, if the local governments start to operate a fleet of autonomous vehicles, especially, robo-taxis as they operate public transportation. This disruption could also take place if automakers and other stakeholders start operating their autonomous vehicle fleets for public transportation.

Global automakers and suppliers should prepare themselves for this transformation since the E-hailing market is likely to grow at a different rate and take different forms in various regions. While E-hailing probably takes a heavy toll on new vehicle sales, automakers will have to strategically reposition themselves in the market to take the pie of this growing market.

Need a thought partner?

Share your focus area or question to engage with our Analysts through the Business Objectives service.

Submit My Business ObjectiveOur Clients

Our long-standing clients include some of the worlds leading brands and forward-thinking corporations.

- © 2021 Cheers Interactive (India) Private Limited. All rights reserved. FutureBridge ® is a registered trademark of Cheers Interactive (India) Private Limited.