FutureBridge: Funding for Cultured Meat Companies up 266% in 2020

“While barriers to commercialization remain, there are signs cell-based meat may soon be a reality in the marketplace.” – says FutureBridge

UTRECHT, The Netherlands — February 5, 2021 — Even at the height of the pandemic, 2020 was a good year for cultured meat companies, with investments hitting record levels and the first regulatory approval in Singapore for the U.S. start-up, Eat Just.

In the last decade, dozens of start-ups have sought to make cell-cultured meat both tasty and affordable with the end goal of persuading consumers to turn their backs on conventional meat. Start-ups like Shiok Meats, Future Meat Technologies, and Memphis Meats argue that their products are healthier for consumers and better for the environment.

Based on FutureBridge’s research, investments in cultured meat start-ups indicate investors are buying into their claims. Global cultured meat start-ups received over $318.6 million in funding in 2020, a 266% increase over the previous year.

“We are now witnessing cultured meat products move from the lab to the factory,” said Sarah Browner, Senior Analyst at FutureBridge. “Many cultured meat companies believe they will have commercial products ready within the next few years. However, they caution that it is more important to get the release right than to do it quickly.”

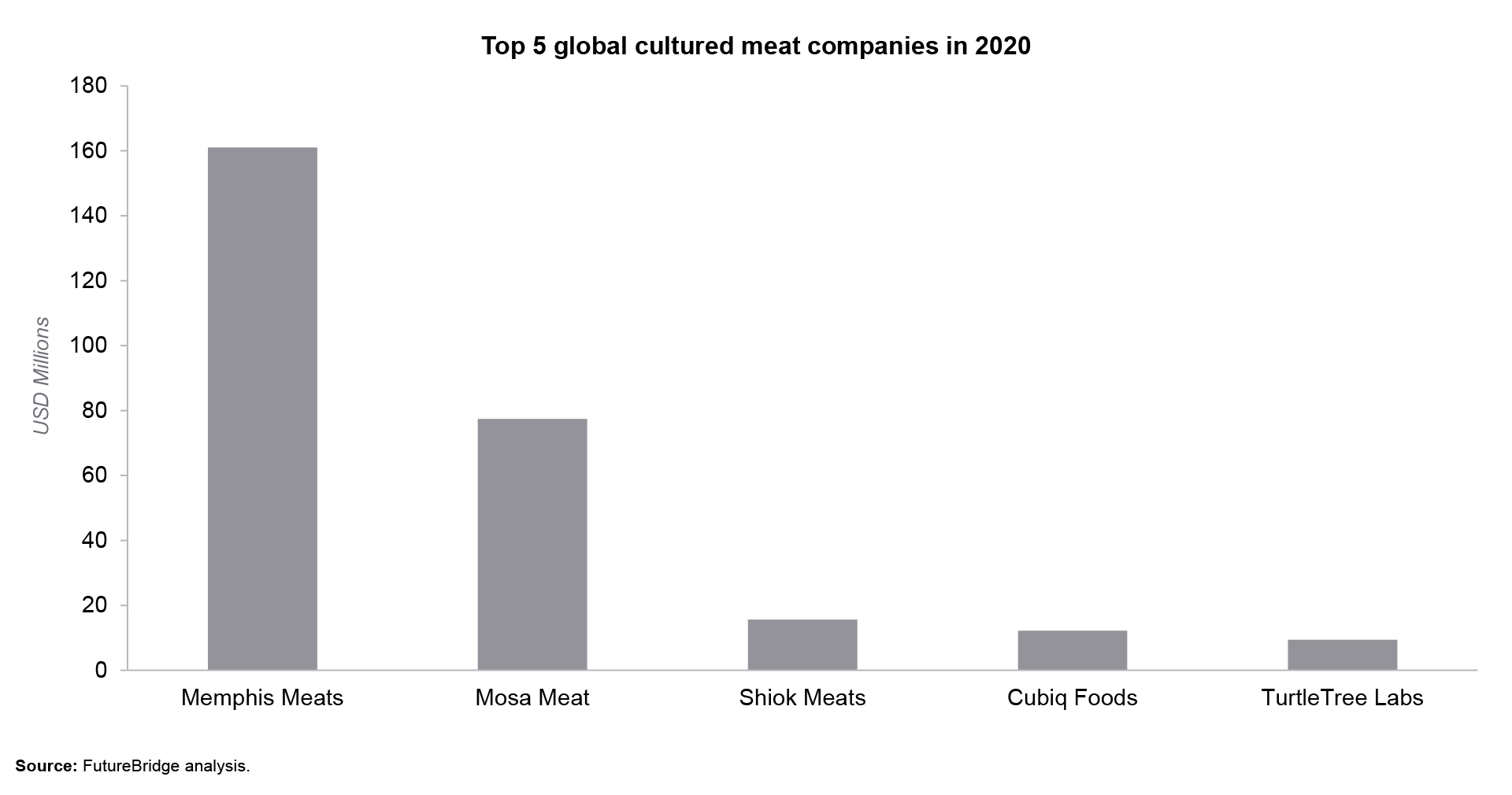

San Francisco-based start-up Memphis Meats led the 2020 funding haul. Backed by big conventional meat players, Tyson and Cargill, the company raised a $161 million Series B round, bringing its total haul to $181.1 million.

Start-ups from the Netherlands also feature prominently in the list of most funded cultured meat start-ups in 2020. Mosa Meat, the Dutch start-up founded by cultured meat pioneer Mark Post, received $75 million in a second funding round. The company, which made the world’s first cultivated beef burger, raised funds to upgrade to small-scale output in the first half of 2021. It is targeting a full industrial site as early as the end of 2022.

The research outlook projects accelerated developments in the cultured meat sector through the rest of 2021 and beyond. Reducing cost, increasing scale, and achieving regulatory support will be the key challenges that companies will need to overcome in the coming years.

For Interviews/More Information: media@futurebridge.com

Our Clients

Our long-standing clients include some of the worlds leading brands and forward-thinking corporations.

- © 2026 Cheers Interactive (India) Private Limited. All rights reserved. FutureBridge ® is a registered trademark of Cheers Interactive (India) Private Limited.