Solid-state Batteries to Make Inroads in EVs by 2025

Listen to this Article

mins | This voice is AI generated.

mins | This voice is AI generated.

Solid-State batteries promise a leap forward in safety and performance to power future electrified & sustainable Mobility

In the 2020s, urbanization, digitalization and sustainability continued to drive significant change in Mobility. Electric vehicles (EVs) will enter the mainstream and claim a larger share in the future propulsion mix. The impact will be even more in urban environments that offer an abundance of EV charging infrastructure already. Moreover, batteries will increasingly become the heart of electrified mobility services, from ride-hailing to e-scooter sharing. Subsequently, novel mobility propositions, such as electrified personal jets, are expected to come to market before the end of the decade. All these use-cases pose significant techno-commercial challenges to the development of battery technologies.

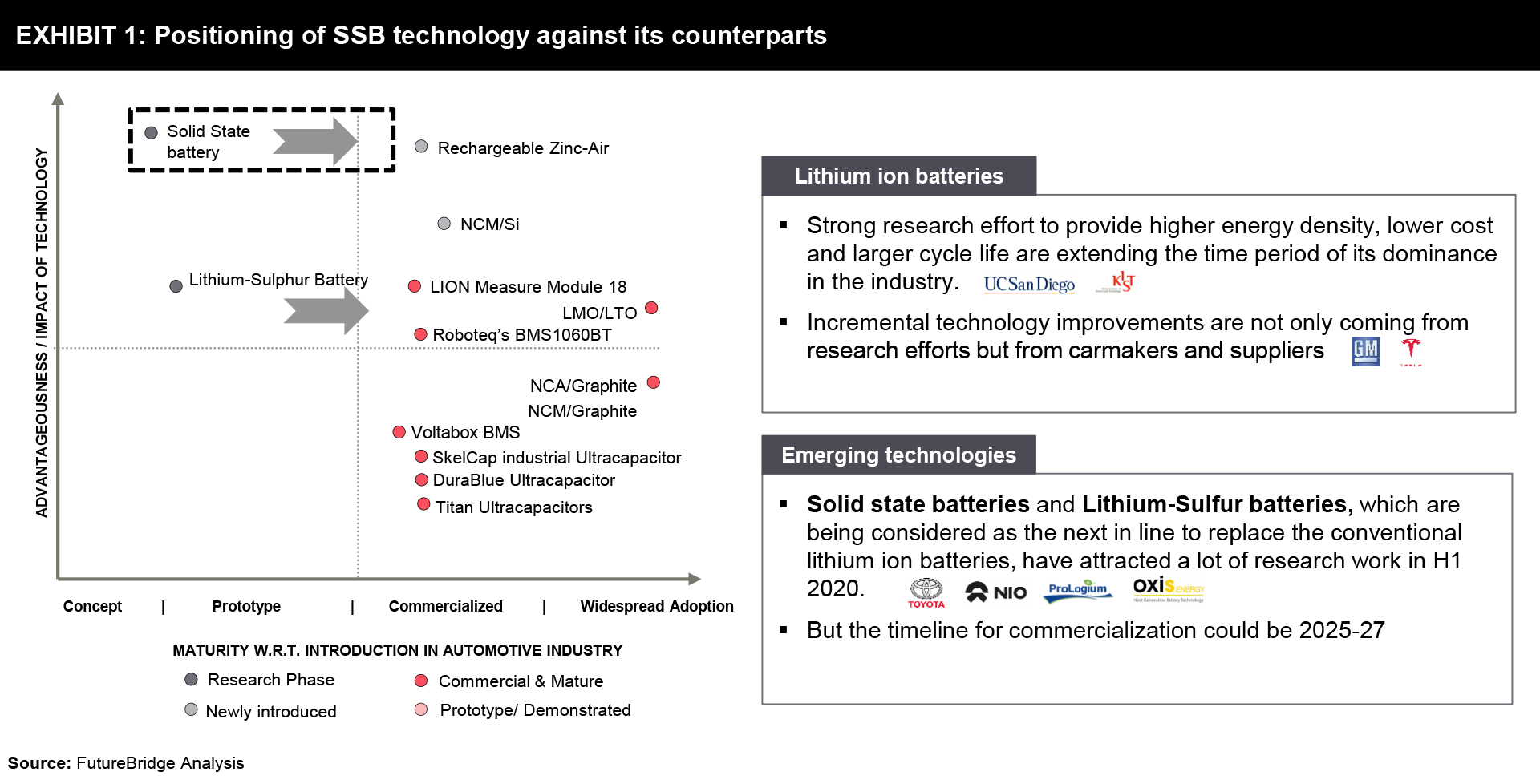

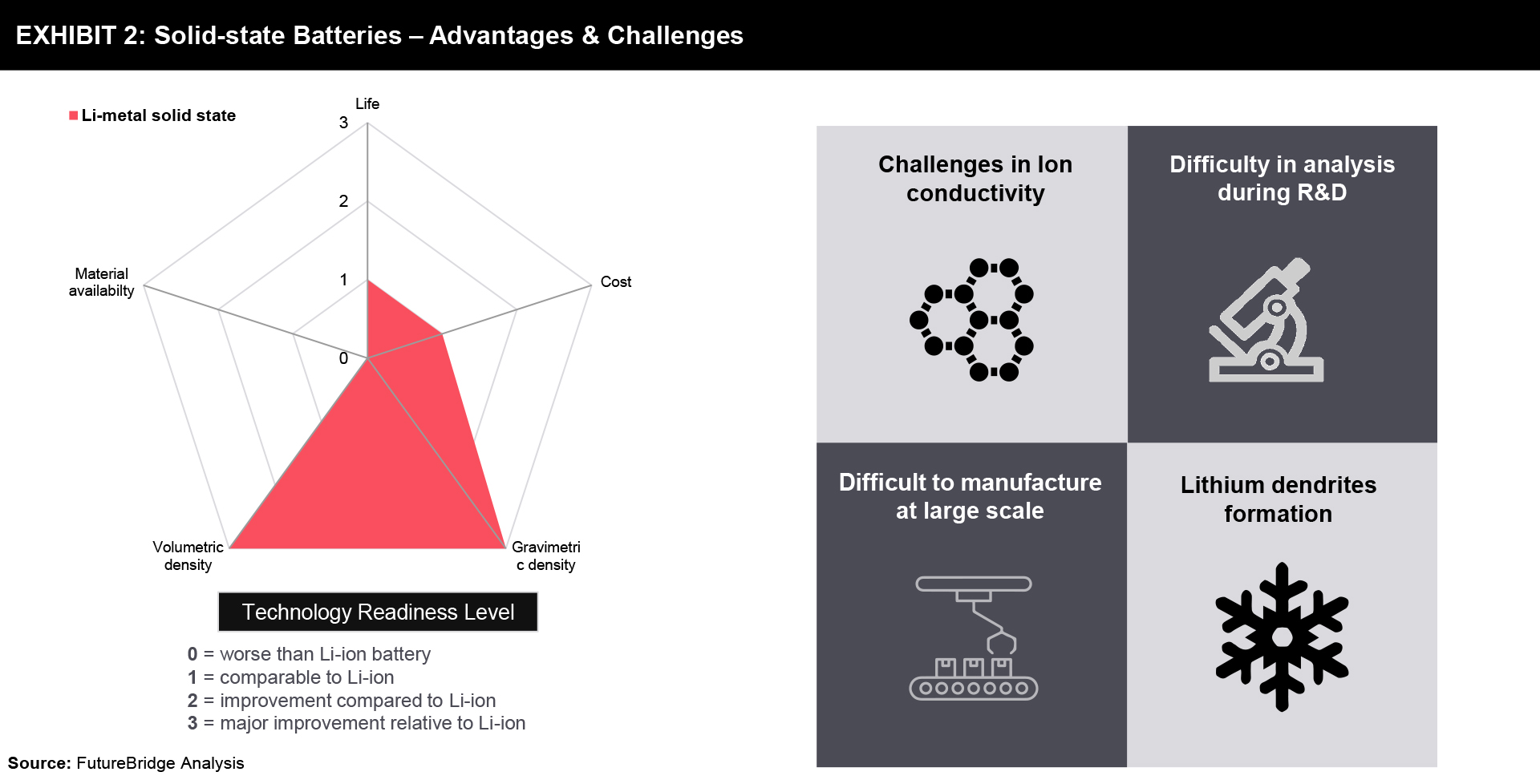

Below Exhibit 1 demonstrates the overall positioning of various battery technologies and clearly shows that although in its early stage of maturity today, SSB may significantly impact the future.

Innovations in Lithium-ion battery technology for EVs, a dominant battery technology today, could provide only incremental performance gains towards theoretical limits. Hence, this may not be enough to meet the requirements of cheaper EVs with more extended range, long battery life, high-temperature operation, and quick and wireless charging infrastructure.

Solid-state batteries are gaining interest from the industry and could reach expected trigger-points by 2035

Low-cost solid-state batteries (SSBs) with high cycle-life present strong potential to power future electrified and sustainable Mobility, once manufactured at scale. Solid-State batteries promise a leap forward with improved safety, higher energy density, faster charging times, and longer life.

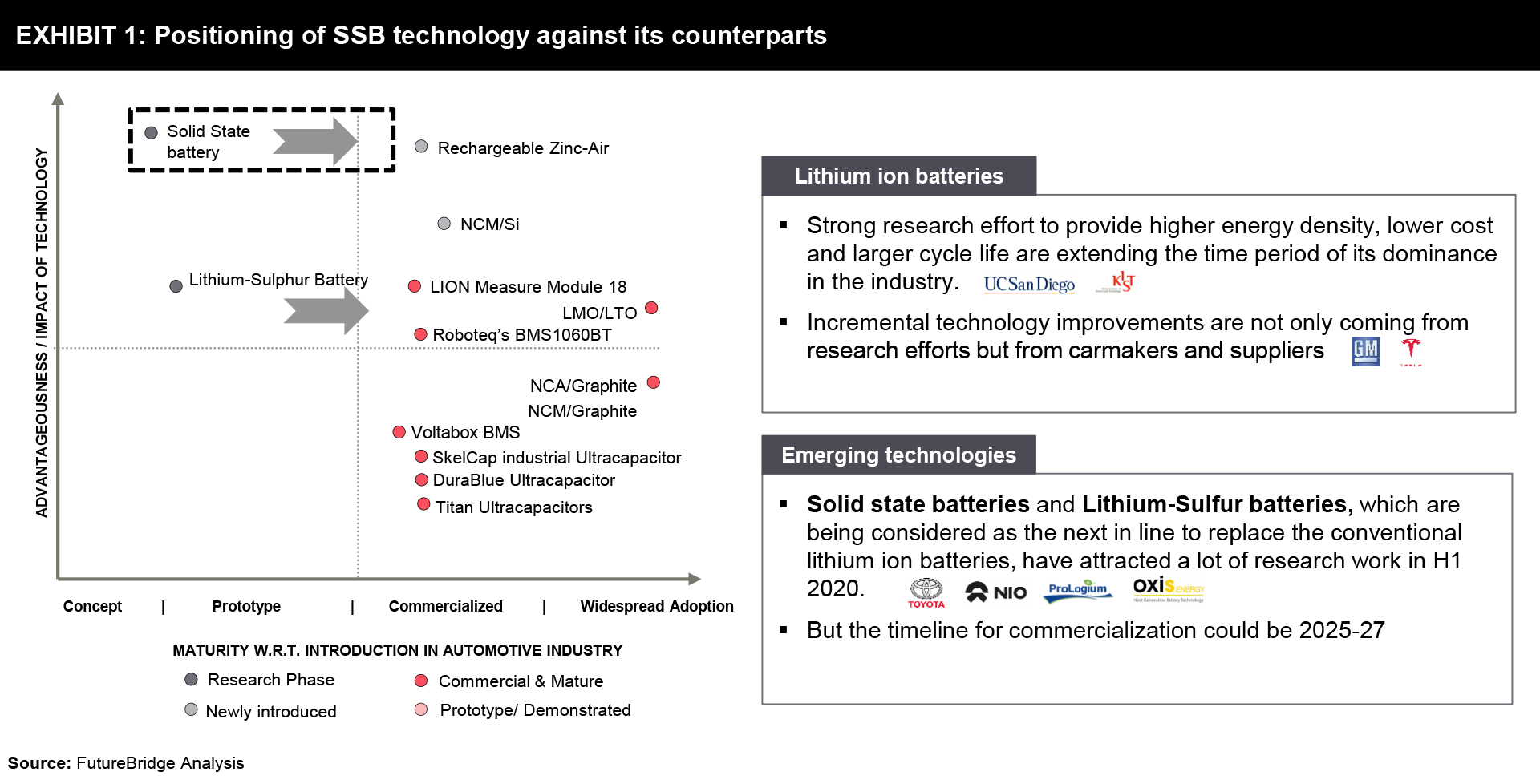

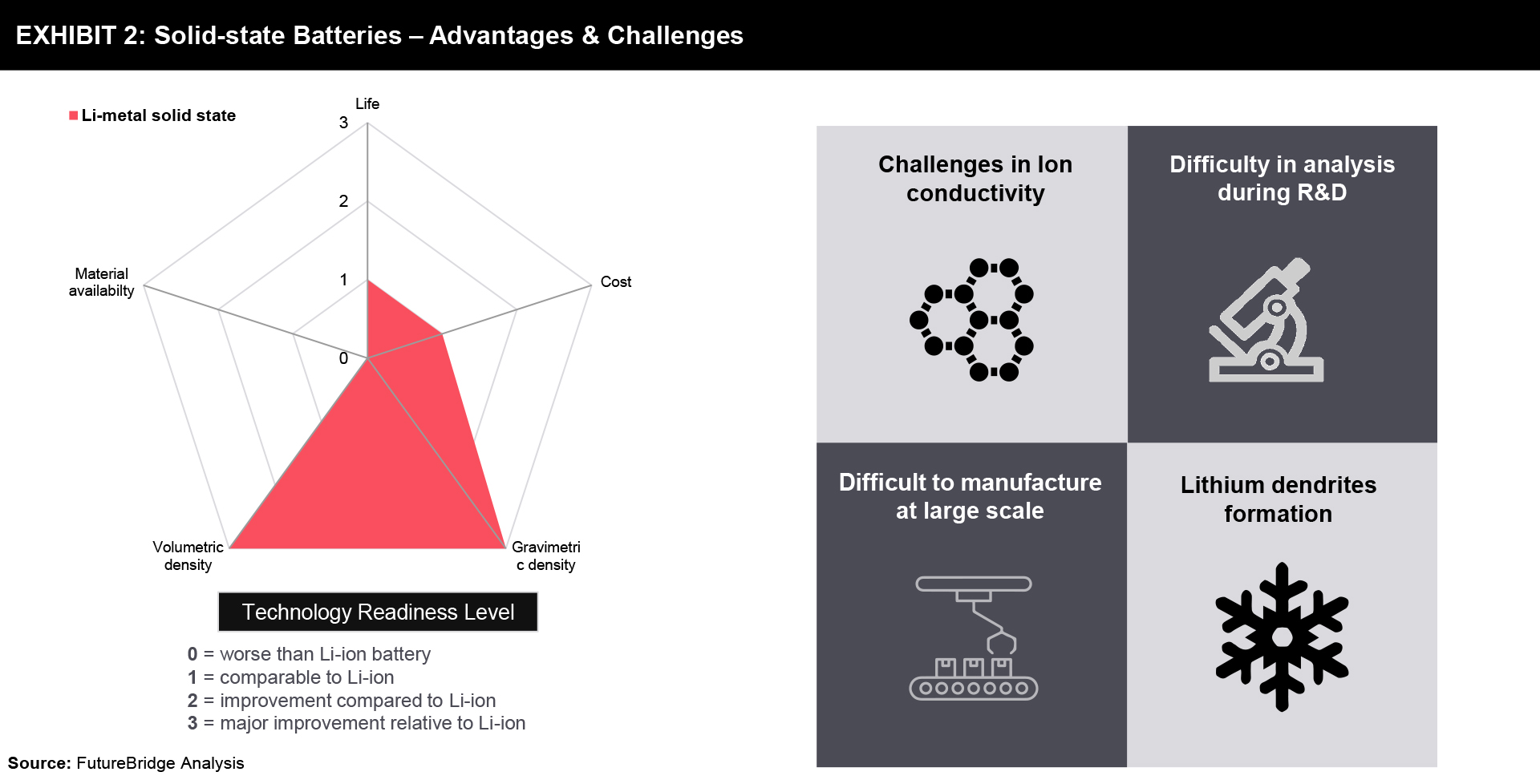

Let’s take a look at SSB’s technology readiness level, advantages, and challenges associated with it in Exhibit 2 below.

“SSBs still have an issue with the supply chain as some materials like solid electrolytes need work from the supply chain and many materials are not available in large volumes” Denis Pasero, Product Commercialization Manager at ilika.

To achieve practical energy densities, SSE layers have to be designed thinner than 50μm. However, the low mechanical properties of inorganic SSEs make them brittle, posing challenges for processing ASSBs in large formats. Additionally, methods to produce solid electrolytes at larger scales are not well established. Most synthesis protocols require multiple energetic processes that include numerous milling, thermal annealing, and solution processing steps. Finally, there is difficulty in analysis during R&D. In all-solid-state batteries, everything is solid or buried, which makes characterization down to the nano-scale immensely challenging.

What’s more, many of the promising Solid-State Electrolyte (SSE) materials are either too costly or too difficult to scale up for high-volume manufacturing. For example, many become highly brittle when thin enough for roll-to-roll manufacturing, which demands thicknesses of under 30 micrometers. Incremental improvements in Li-ion batteries’ cost will challenge the cost-parity with SSBs and might delay the introduction of SSB into the automotive market. FutureBridge expects that cost-parity between Li-ion and SSBs could be achieved in another five years.

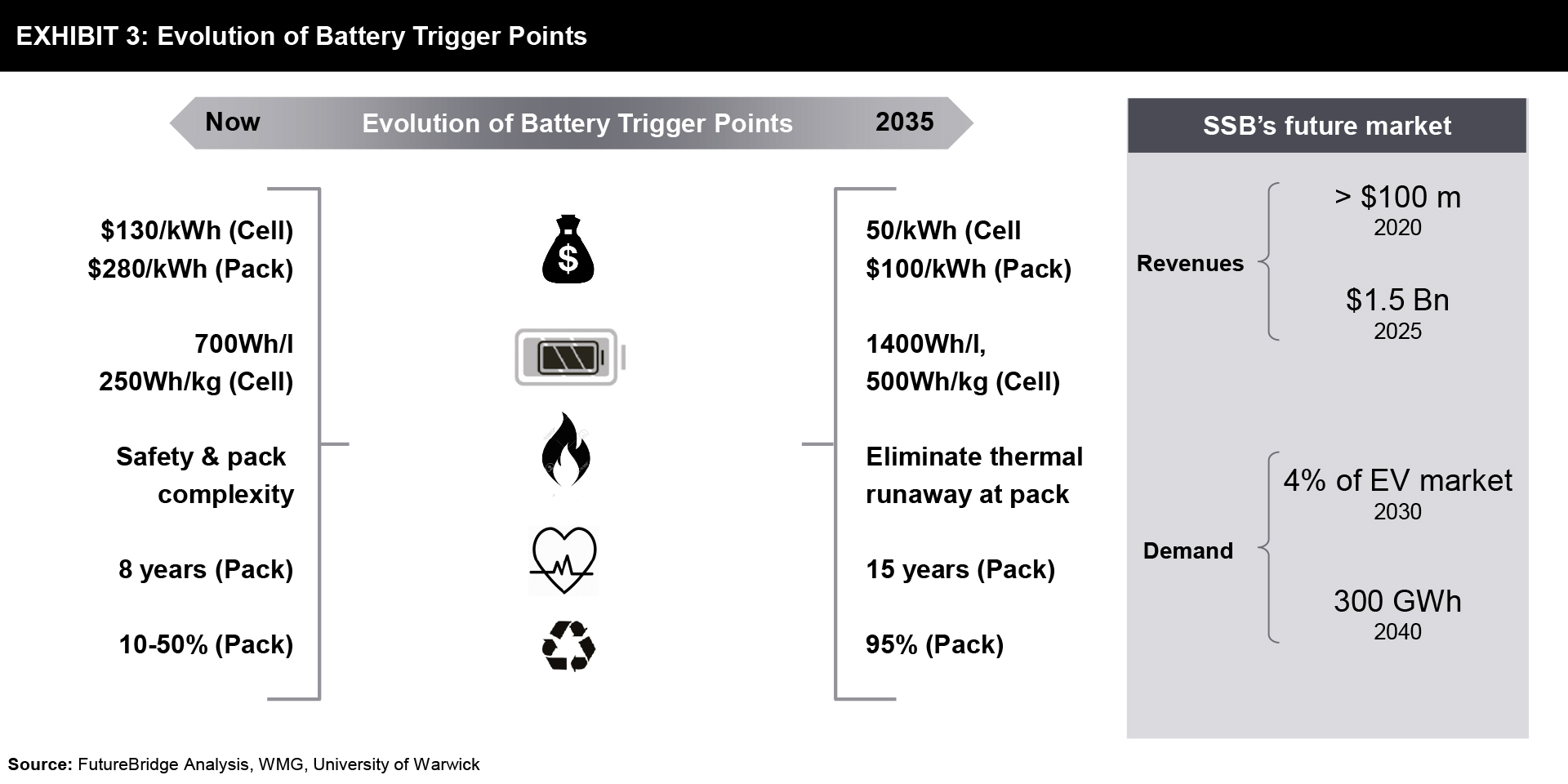

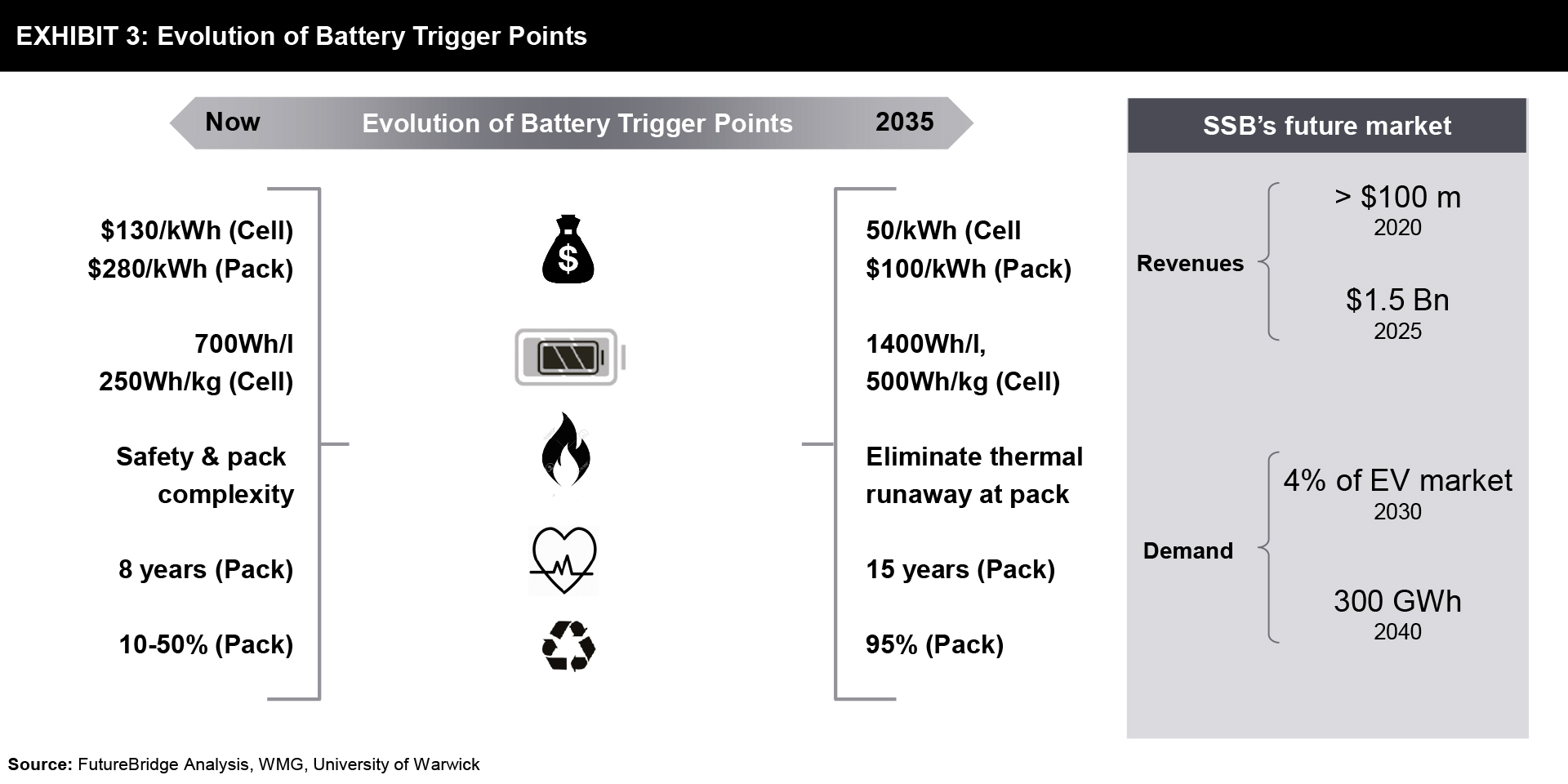

Although SSB technology faces diverse challenges today, the growing research and breakthrough are expected to take the trigger-points needed to enable its large-scale implementation.

To capture the size of the opportunity, a report by the Faraday Institution published a year ago estimated that SSB revenues would grow by a factor of 15 between 2020 and 2025, from less than $100m to $1.5bn in 2025.

But they would still claim a single-digit market share from the global sales of Li-ion batteries for EVs. Also, in 2030 SSB is likely to take a 4% share of the worldwide EV market, whereas, in 2040, annual demand for SSB in transportation could reach 300GWh.

Accelerated research aims at mass-commercialization before the 2030s

Today the commercialization of SSBs is limited to micro-scale applications outside the Mobility industry, such as medical devices. The development of large-sized SSBs for mobility applications is still in its early stages. Solid Power, Quantum Scape, and Ilika forecast at least five years for SSBs to enter the automotive market.

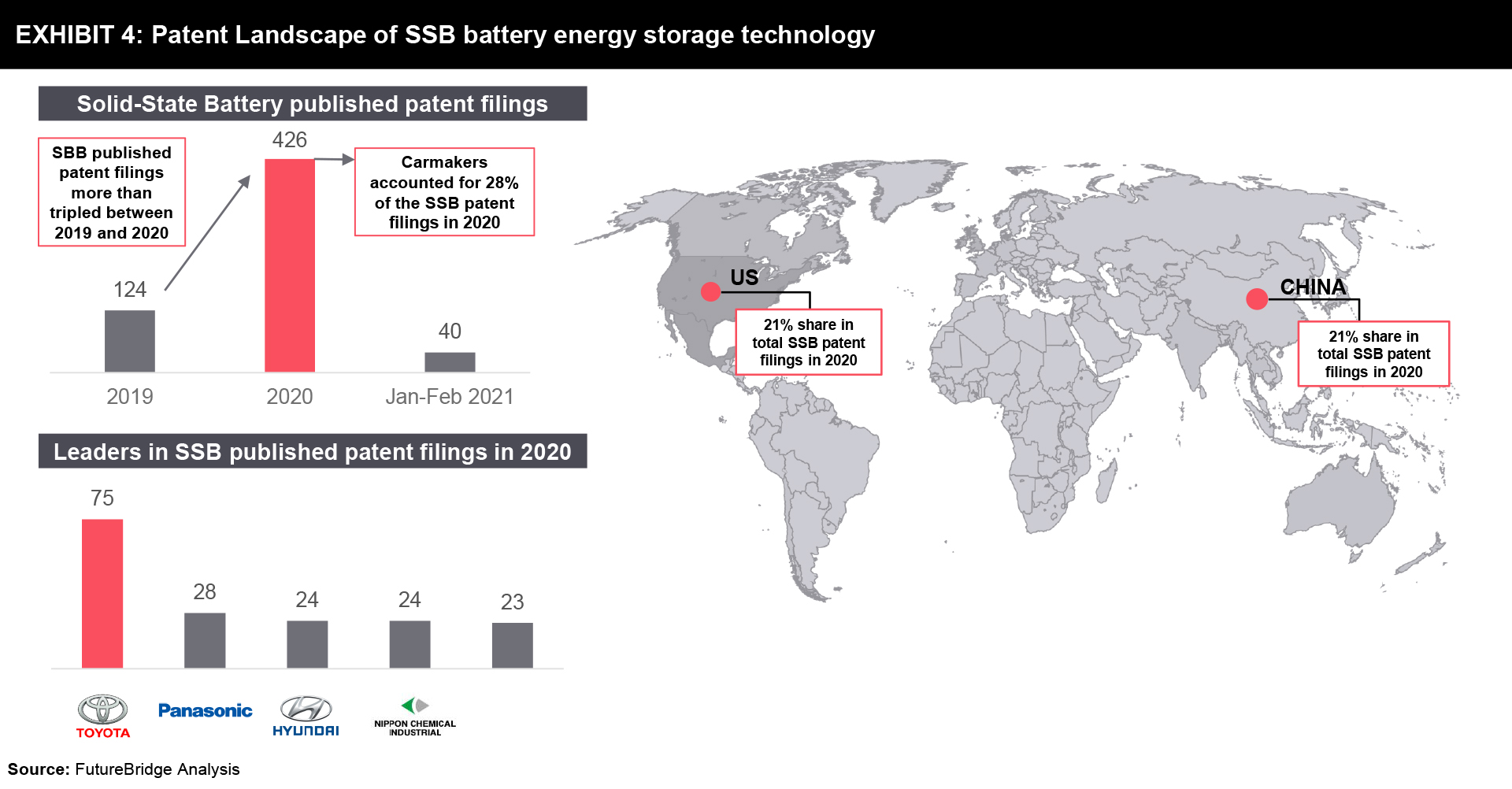

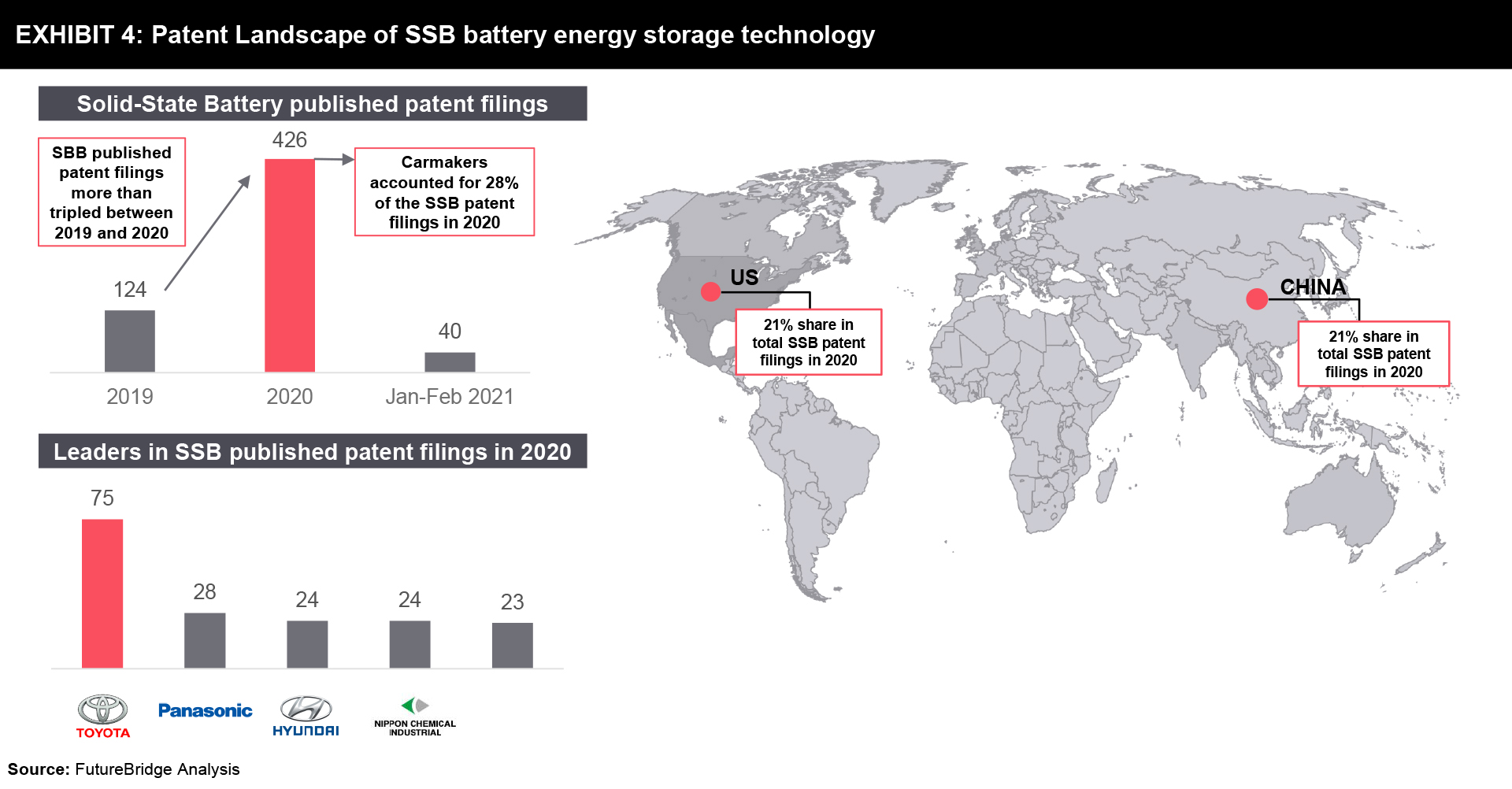

2020 saw a growing number of research projects to improve cycle life, energy density, and ionic conductivity – the main three challenges for mass-adoption of SSB for EVs.

While recent innovation in ceramic solids has improved the ionic conductivity of solid electrolytes, the battery industry still faces technical challenges in the interface between the electrodes and the electrolyte.

The evolving ecosystem and competition in SSBs and road ahead

While research in SBBs accelerates, the ecosystem of players is growing to monetize high-risk, high-reward opportunities.

New tooling, manufacturing systems, and new supply chains open up opportunities for companies that couldn’t otherwise compete with today’s leading entities.

Research pioneers race to accelerate roadmaps for the game-changing Solid-State Battery technology for Mobility by 2025. The recent innovation in ionic conductivity is promising. Future innovations will pave the way for improvements in cost and cycle-life, which remain the most critical challenges for the mass-market commercialization of SSBs.

Overall, SSB has a lot going for it, but at the same time, one of the most significant factors in the whole industry going against it. And that’s the price!

References

Share your focus area or question to engage with our Analysts through the Business Objectives service.

Submit My Business ObjectiveOur long-standing clients include some of the worlds leading brands and forward-thinking corporations.