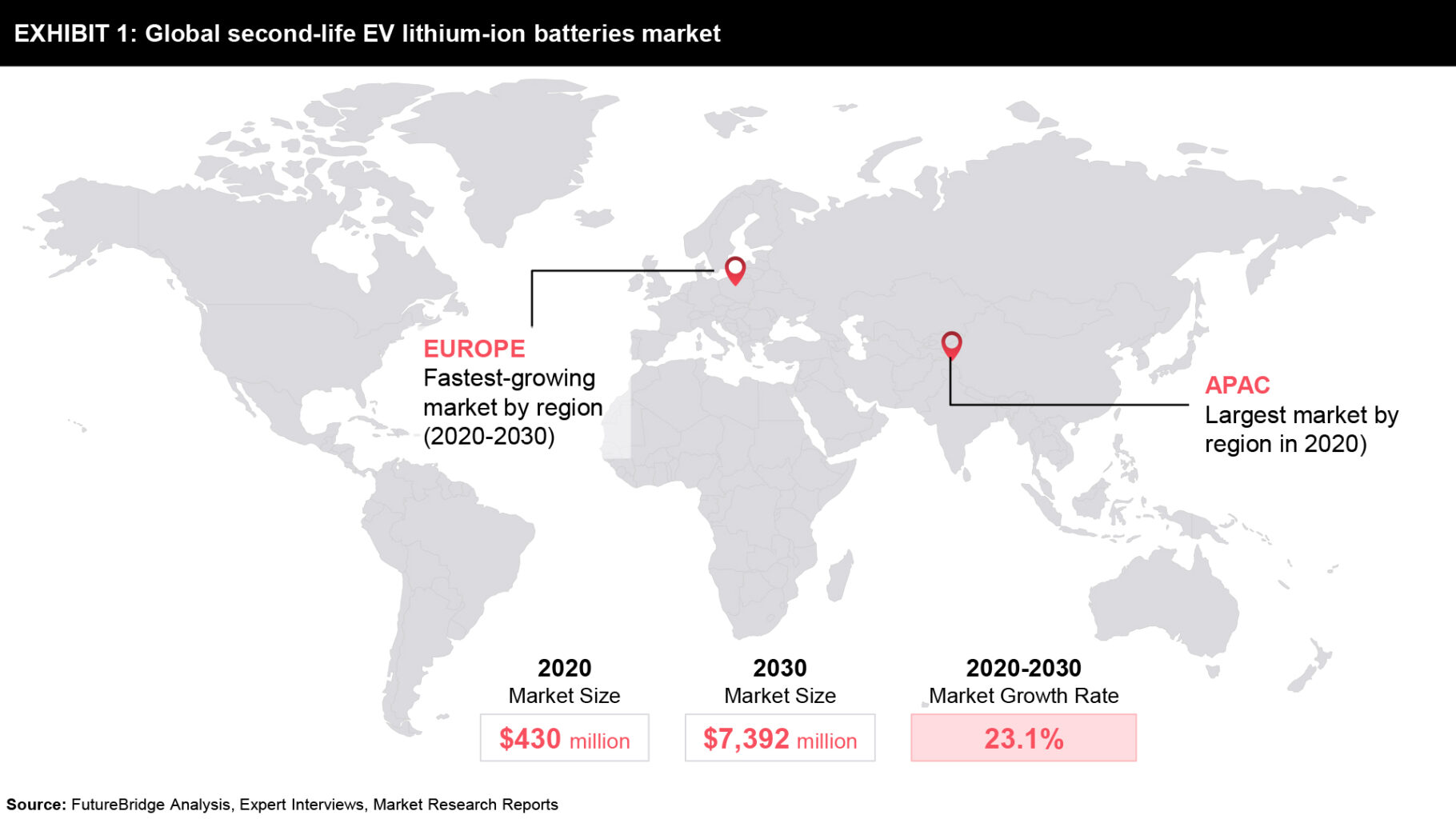

Demand for Lithium-ion batteries will grow in the coming decades with the rapid adoption of electric vehicles. As electric vehicle batteries begin to reach their end-of-life, we will see an exponential growth of retired Lithium-ion batteries coming out of vehicles. By 2020, we already had around 14 Giga-watt-hour or roughly 102,000 tonnes of Lithium-ion batteries retiring from electric vehicles. With such an upsurge in the adoption of electric vehicles, by 2040, the total amount of electric vehicle batteries reaching end-of-life is expected to reach around 7.8 million tonnes per year.

Spent electric vehicle batteries are not entirely dead after their first-life-use and can still be useful in less-demanding applications. The battery can either be “Recycled” to obtain the raw materials or repurposed for a “Second-life” in alternative applications. “Second-life” lithium-ion batteries are still left with a lot of juice in them to be used again; however, the concept of using such batteries in stationary applications has yet to gain real market traction. Growing automotive industry interest, new research, and an expanding startup ecosystem suggest that this could now finally be changing.

To further put this in perspective, Exhibit 1 below presents a global outlook for second-life EV batteries.

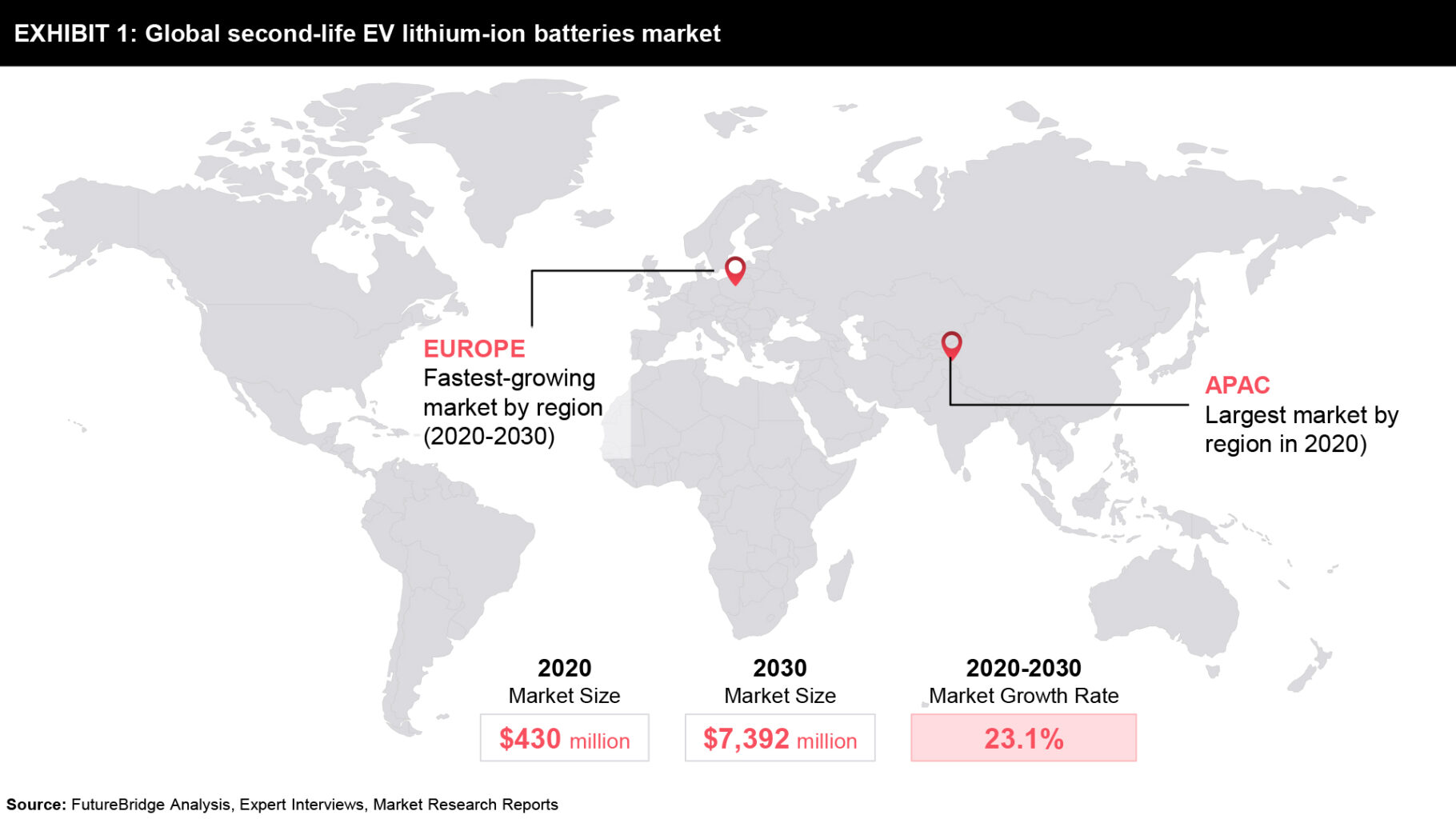

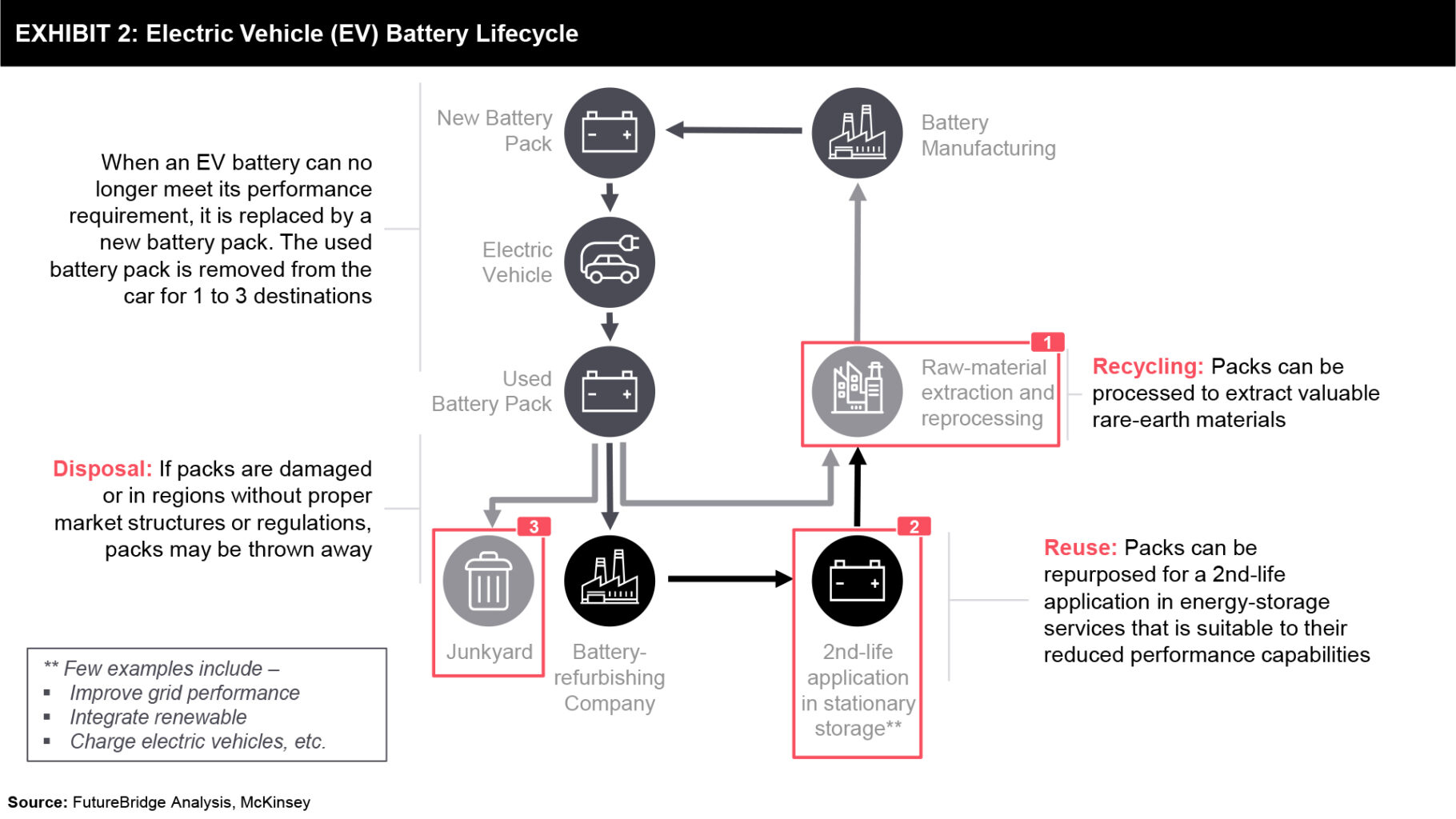

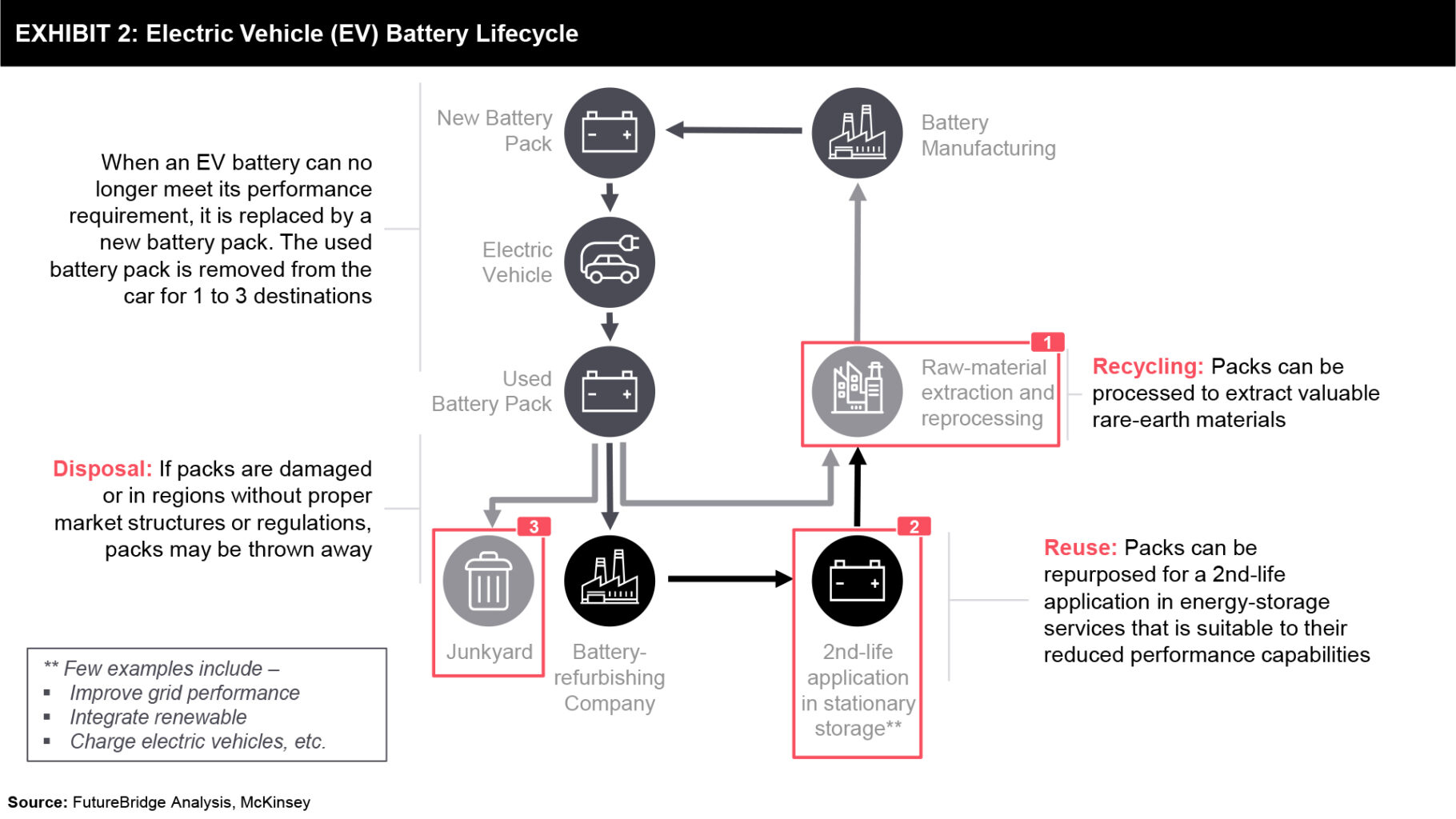

Before we further deep-dive into second-life EV batteries and their applications, it could help look at an EV battery’s overall life cycle. Exhibit 2 below presents a complete electric vehicle battery life cycle explaining when an EV battery can no longer meet its performance requirement (reliable acceleration and range), how it can be explored for other applications.

Once a battery at the end-of-first-life is removed from an electric vehicle, it has three possible destinations – [1] a recycling facility, [2] a second-life application, or [3] a waste management facility.

[1] Recycling – Once a battery pack is removed from an EV, these packs can be processed to extract valuable rare-earth materials.

[2] Reuse (Second-life Application) – Upon removing a battery pack from an EV, these are supplied to battery-refurbishing companies. They process these batteries to make them suitable for a second-life application in stationary storage, such as improving grid performance and integration renewable, charge electric vehicles, and so on.

[3] Disposal (Waste Management Facility) – a battery, once placed into a waste stream, enters either in a landfill or other disposal facilities with no recovery of its remaining value whatsoever. However, regulations are mandating that lithium-ion batteries enter the circular economy rather than being discarded this way.

EV battery packs’ reuse (second-life) vs. recycling – success factors and economic challenges

EV battery recycling

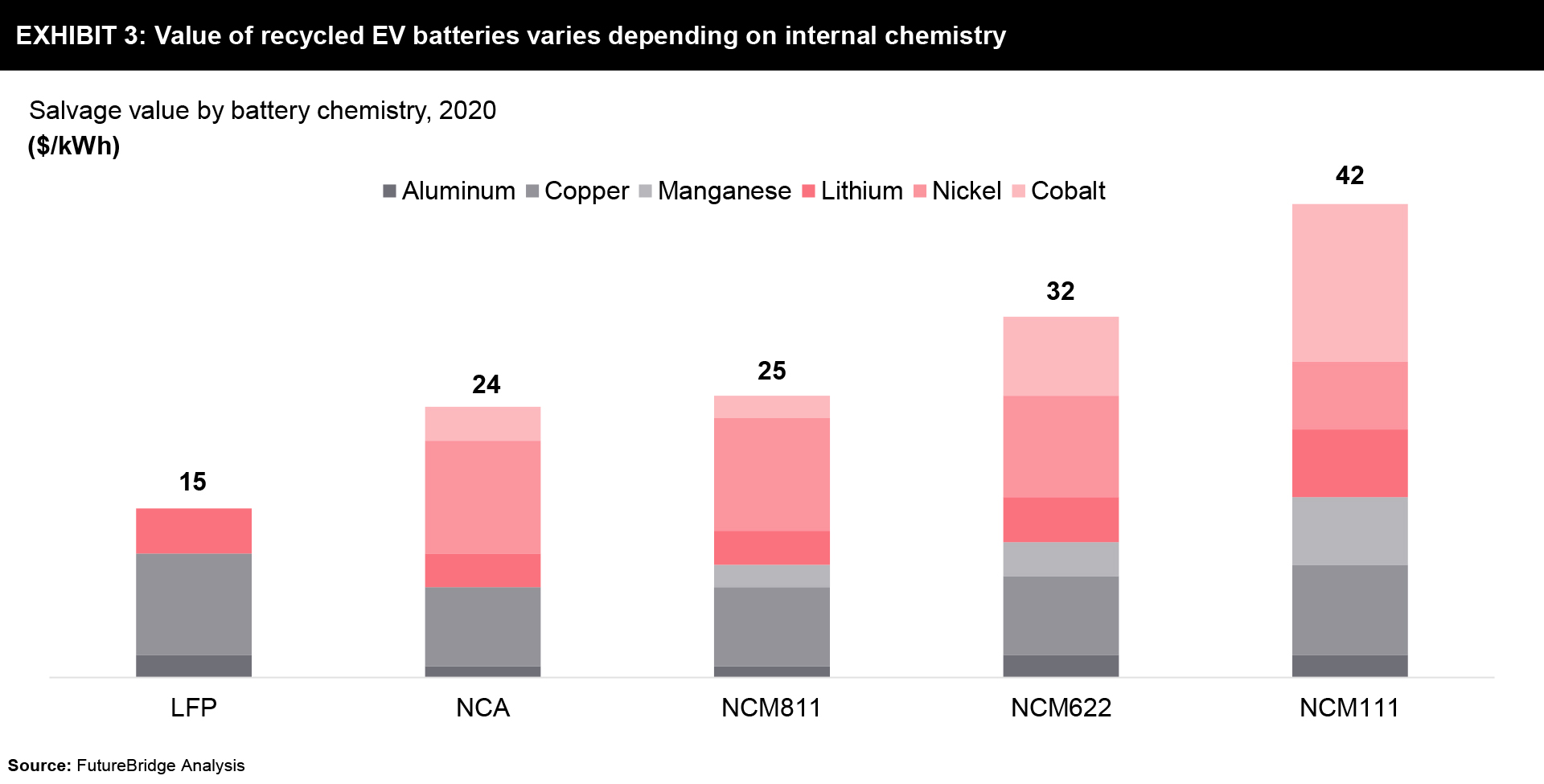

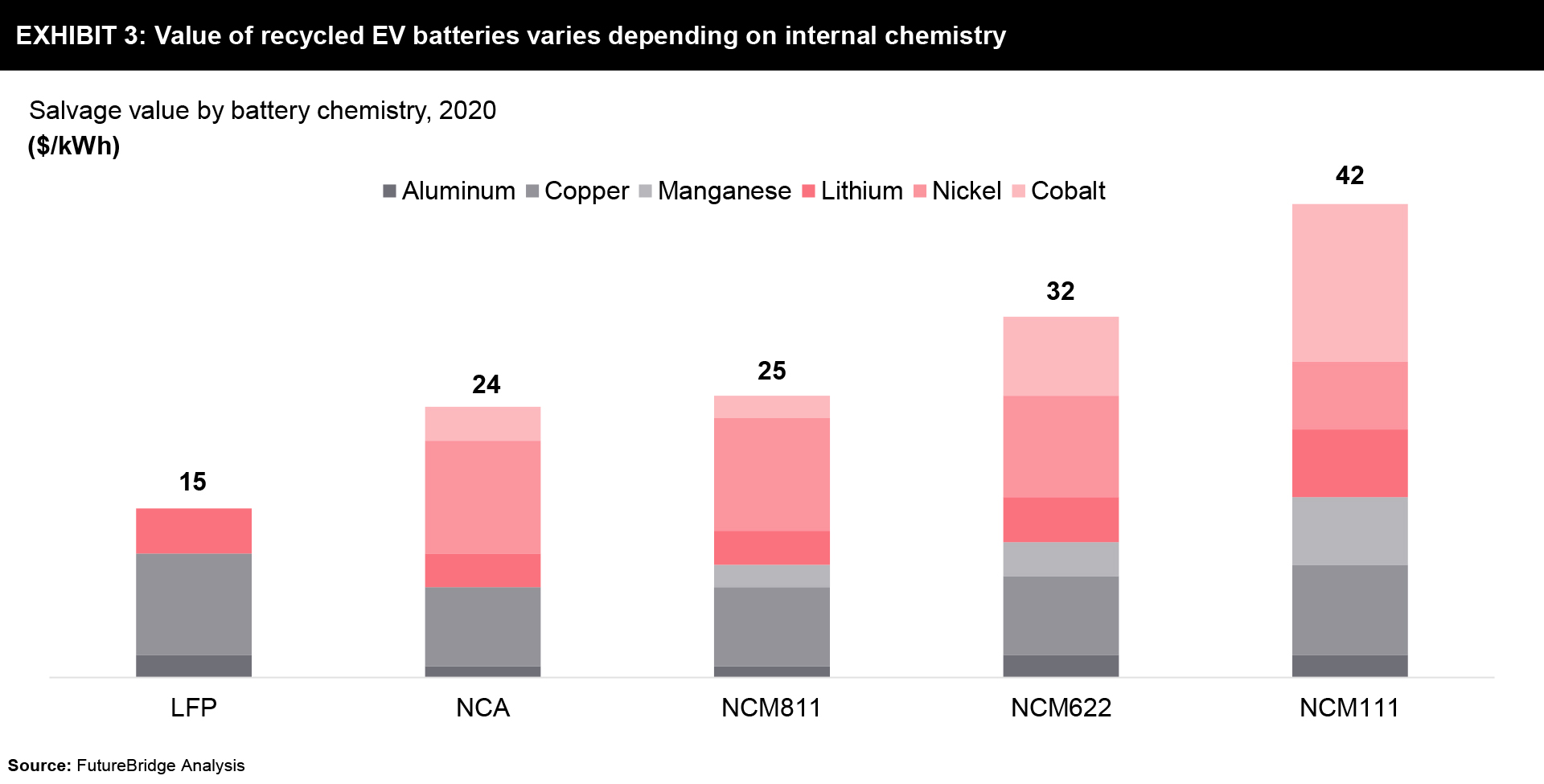

Recycling electric vehicle batteries is an asset-intensive business in which a high utilization rate is extremely critical to achieving operating efficiency. Recyclers of Li-ion batteries in China are the largest and the longest-established players in this space. Performance from them suggests that the industry’s underlying fundamentals are relatively strong. Please refer to Exhibit 3 below. It is particularly true for Li-ion batteries made from nickel-cobalt-aluminum (NCA) and nickel-cobalt-manganese (NCM) chemistries, which are increasingly favored by few automotive OEMs because of their superior energy density.

On the other hand, the operating costs for recyclers are relatively fixed across all the battery chemistries. In general, the recycling process comprises of the same three primary steps: [1] Cell deactivation or discharge (to prevent fire), [2] Pretreatment to deconstruct the significant components of the cell (aluminum, plastics, and cathode), and [3] Recovery of the mixed cathode materials.

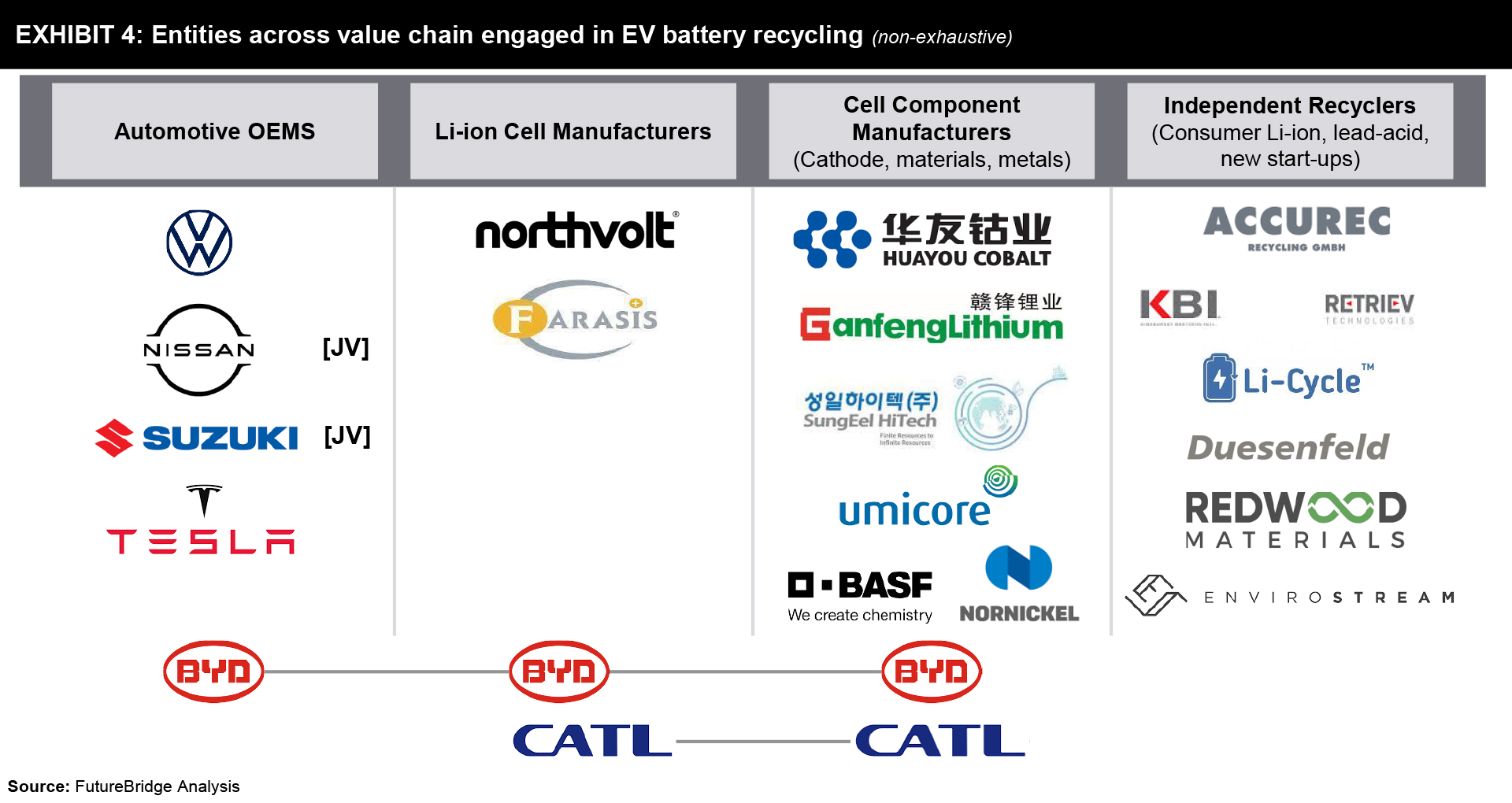

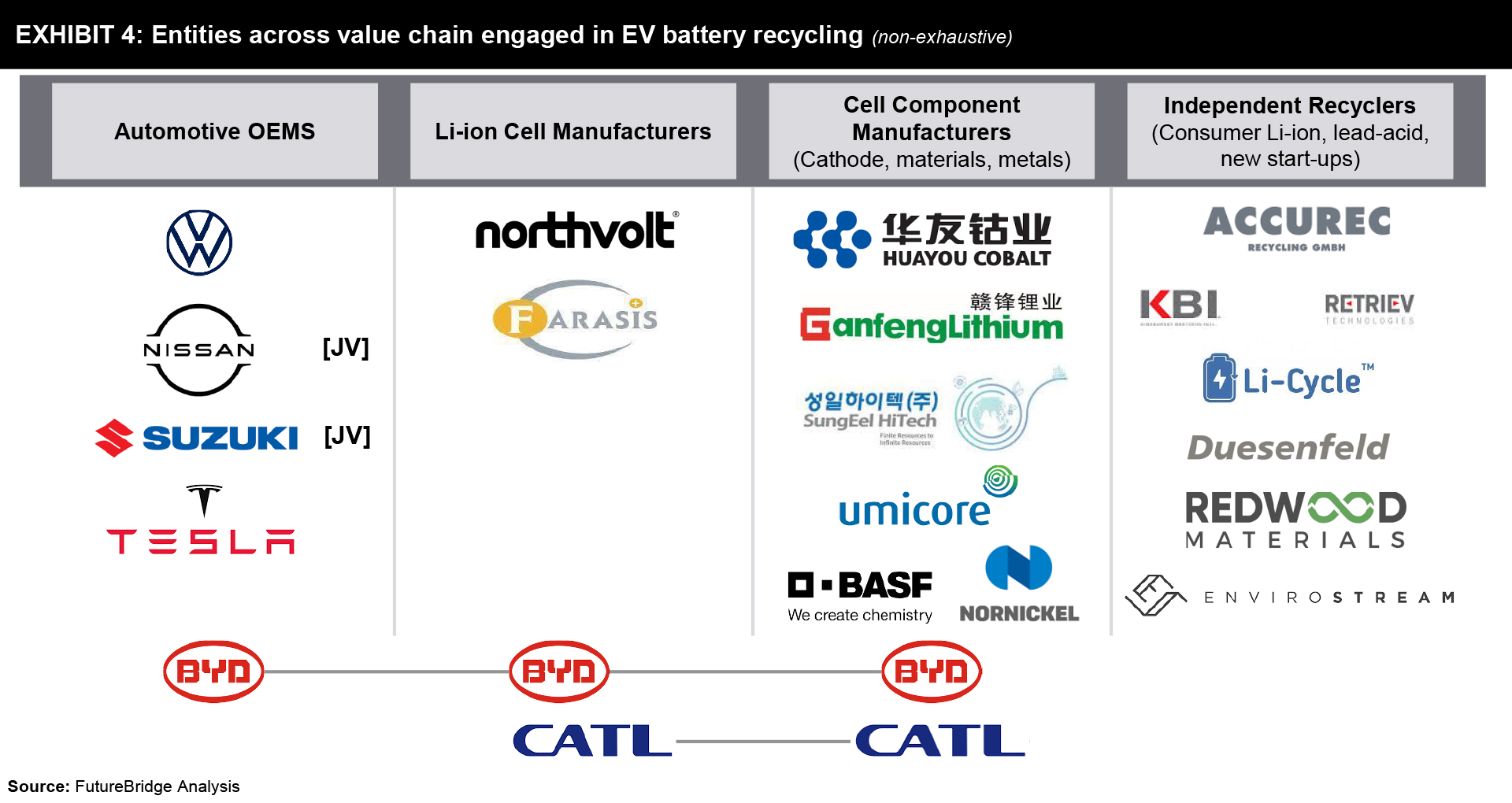

The value chain for lead-acid batteries recycling is straightforward and primarily consists of only battery manufacturers and independent recycling companies. However, the lithium-ion battery value chain flow is considerably more complicated and involves more players. In the existing ecosystem, current active players include recyclers of Li-ion batteries for consumer electronics, recyclers of lead-acid batteries; cell manufacturers; OEMs; and cell component suppliers such as cathode manufacturers and metal refineries (refer to Exhibit 4 below).

OEMs that manufacture cells or cathodes should consider becoming end-to-end participants in the EV battery value chain, as BYD has. As of now, very few entities are positioned to create an end-to-end model in Li-ion batteries in the next few years. Current market dynamics enable a company to contract with various companies inside as well as outside the automotive industry. This can enable them to gain access to the volumes of recyclable batteries needed to operate at-scale facilities and distribution networks. Relationships on both customer and the supplier ends of the recycling process are critical to overall success.

Second-life for electric vehicle battery

On the one hand, where recycling focuses on the value of the battery’s metal content, second-life applications concentrate on the importance of repurposing a partially used battery.

There are three categories of second-life applications: [1] as a spare EV battery, [2] in a stationary energy storage (SES) application, or [3] a compact mobile storage application (such as a forklift). Various estimates show that the demand for batteries in the Stationary Energy Storage (SES) market will reach 120 GWh/year by 2030; hence, there is plenty of demand for a second-life battery. Stakeholders will have to overcome the current economic obstacles to sustaining second-life battery applications.

More than a dozen uses in SES applications alone—spanning residential, utility, and commercial markets — for which Li-ion batteries are gaining interest. These applications include power-generation support (co-location with another power source), frequency control, off-grid supply, emergency backup, consumption optimization, and charging infrastructure.

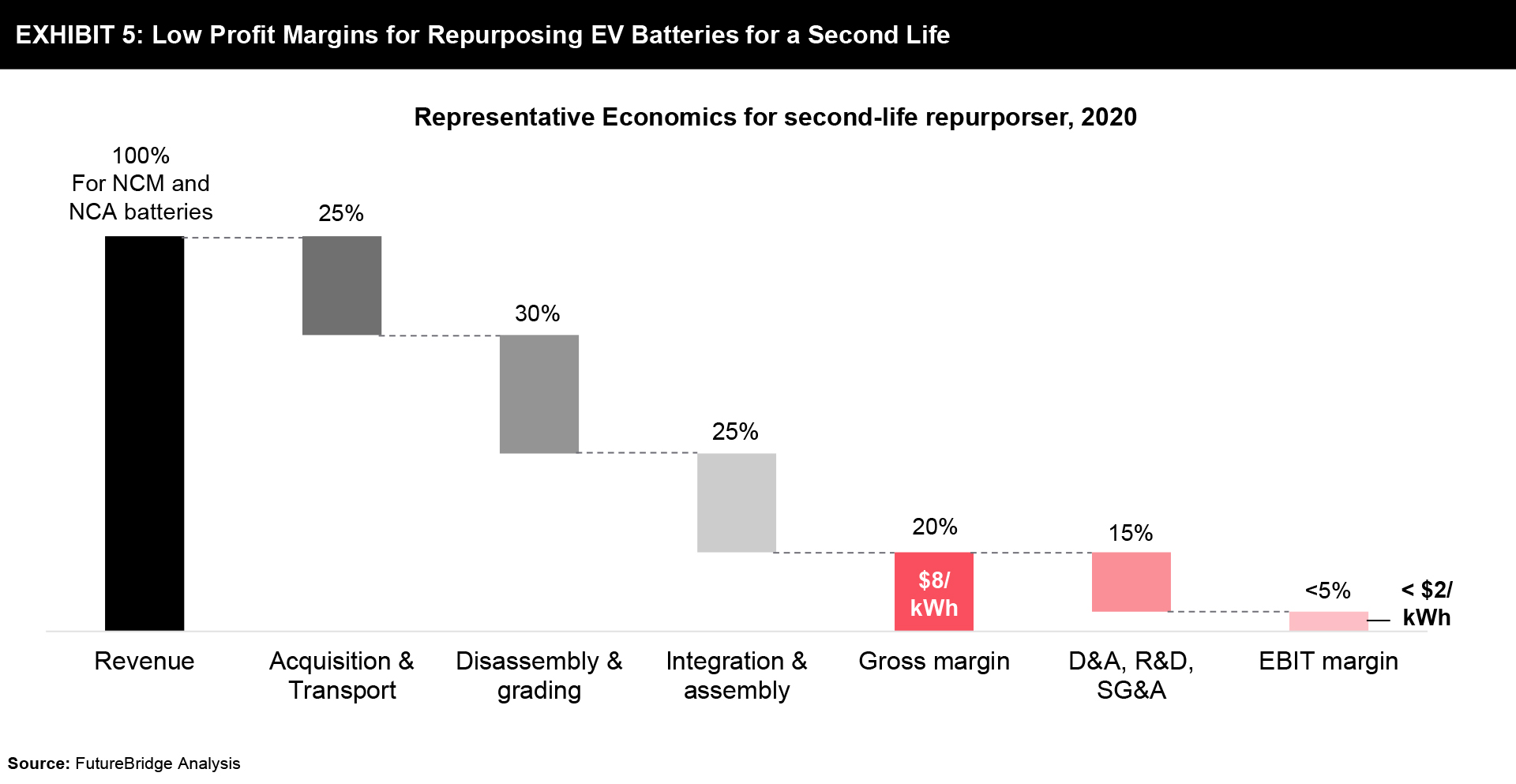

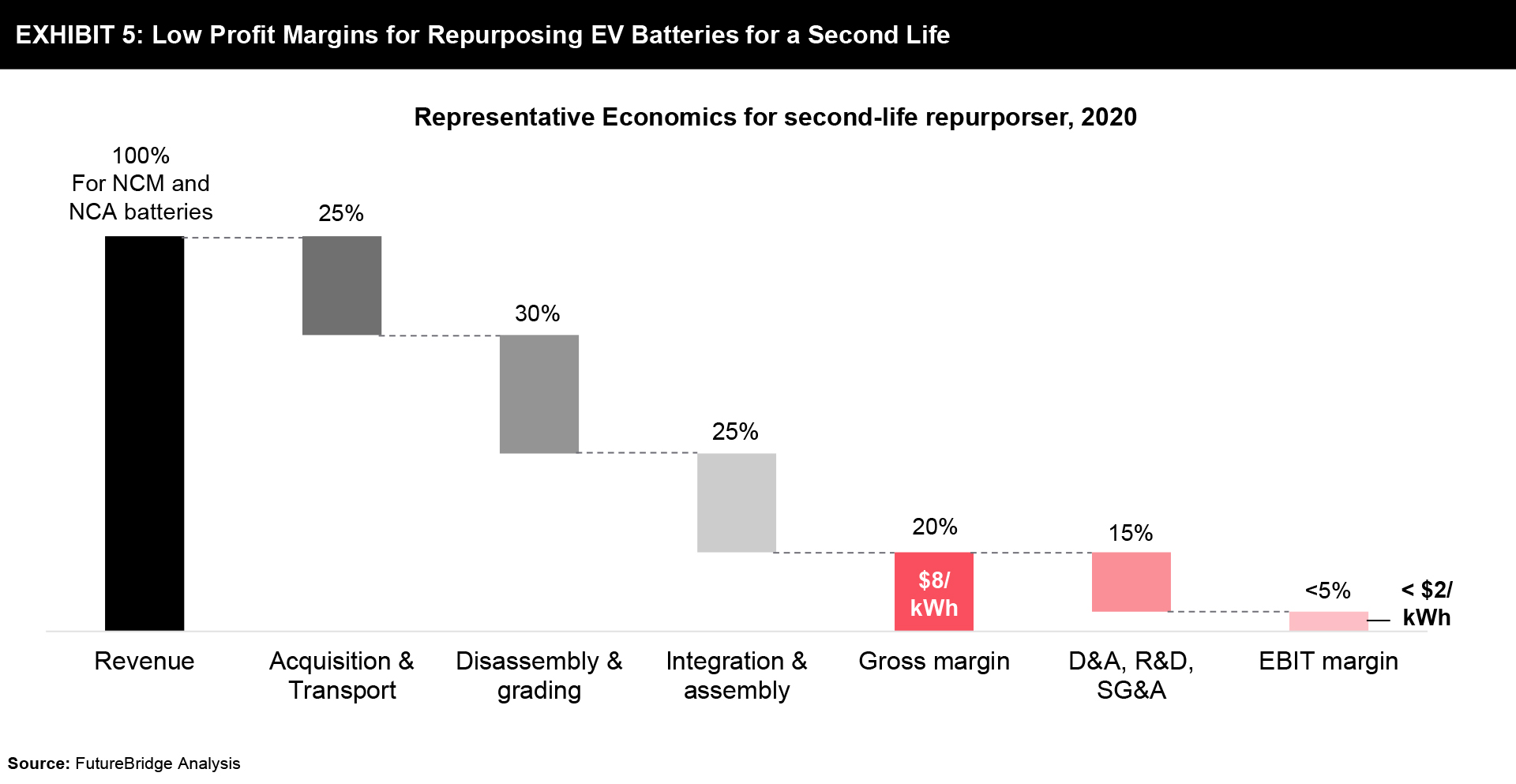

Various analyses show that currently repurposing an electric vehicle battery for a second-life application is economically a big challenge on a standalone basis. The profit is right now too low to make an effort worthwhile. Please refer to Exhibit 5 below.

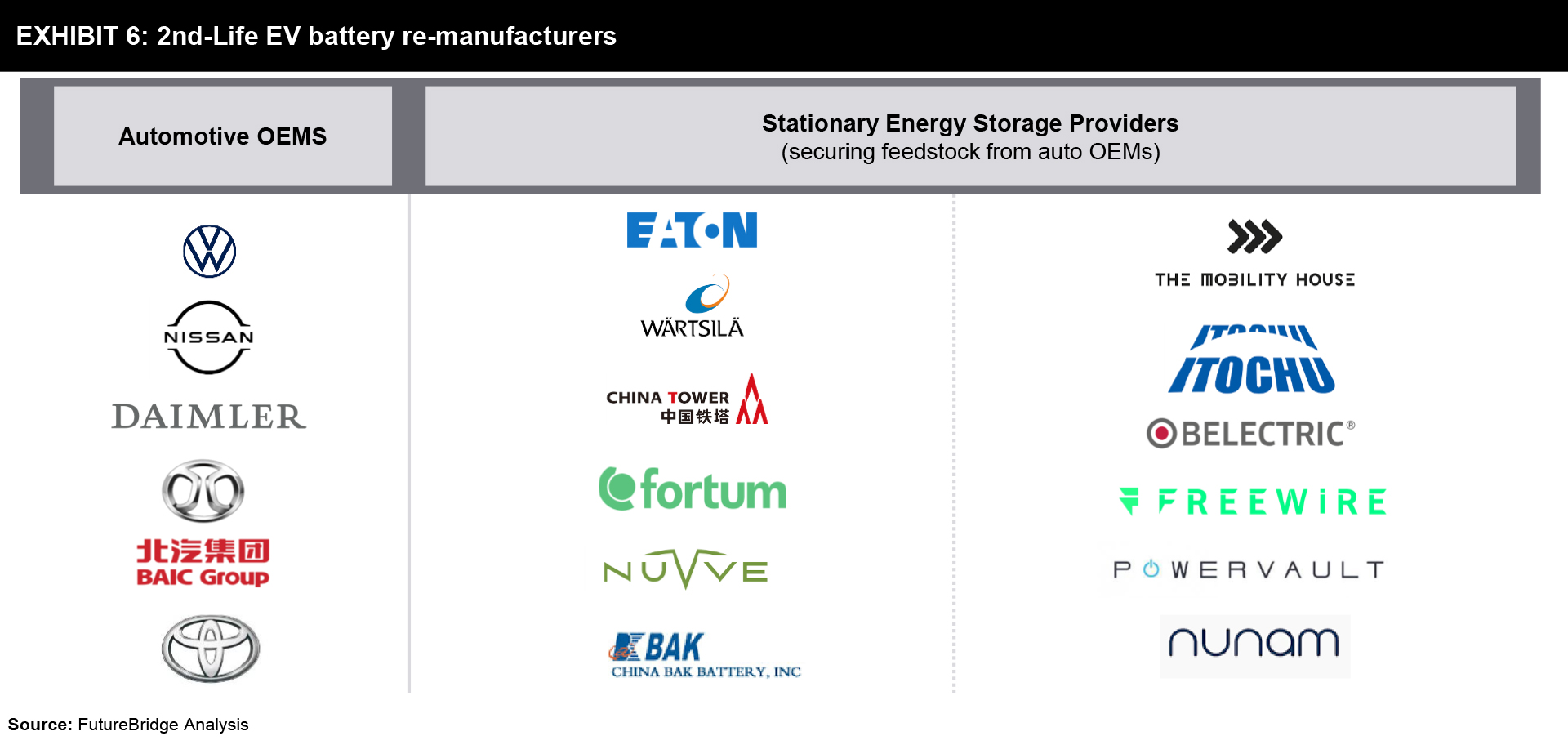

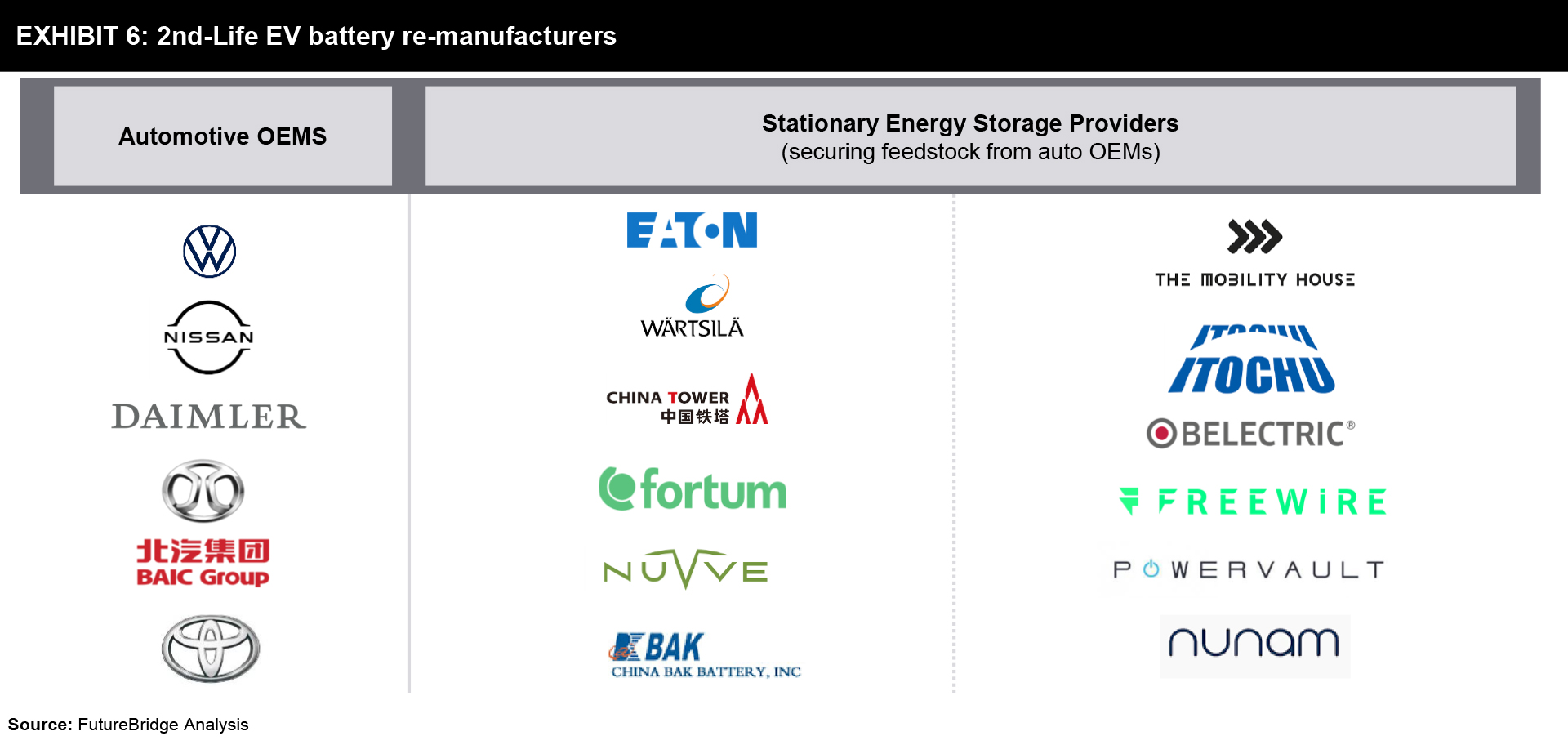

A dominant model in repurposing batteries for a second life might be where OEMs partner with Stationary Energy Storage (SES) companies in the near term. It can further allow OEMs to focus on launching new EV models and managing the transition from vehicles powered by ICE. Cathode and cell manufacturers may steer clear of second-life applications, as these cannibalize their sales to Stationary Energy Storage (SES) markets. Please refer to Exhibit 6 below.

The inclination from OEMs to participate directly will grow as the economics improve. VW, for instance, recently announced their plans to use second-life batteries in charging stations. Similarly, it’s not difficult to imagine Tesla using its second-life batteries in its branded stationery storage portfolio in the future.

In the decades ahead, as there are more advancements in technology, it will indeed shift the value pool in the circular economy from recycling to second-life. In the future, EV batteries will be built better, and they will last longer too. The useful life of EV batteries for second-life applications could exceed by as many as five years. As their remaining useful life (second-life) increases, the economics of second-life applications will improve too.

Future ahead

Recycling is the least sustainable measure in the circular economy and should be the last step when the batteries could no longer be utilized. Hence, retired electric vehicle batteries should be considered for remanufacturing or repurposing for a second-life before recycling.

The decision to recycle or repurpose a second-life for retired electric vehicle batteries can also be dependent on the chemistry of the battery. Lithium-iron phosphate (LFP) is popular chemistry among Chinese electric vehicle manufacturers. Due to safety concerns, it is extensively used in electric buses in China. According to BYD, the LFP batteries leader in China, LFP batteries’ second-use makes business sense. Unlike NCA or NMC batteries, the recycling value of the LFP battery is relatively low because it does not contain high-value metals ($9/kWh for LFP versus $25/kWh for NMC 111 at current metal prices). Besides, LFP has better cycle life and safety performance, an essential factor for stationary storage, rather than high energy density. These reasons make second-life an attractive option for retired LFP electric vehicle batteries.

Whether retired electric vehicle batteries have a second-life or not, all of those batteries will need to be recycled in the end anyway. Recycling provides a robust solution to raw material supply-chain challenges and price fluctuations. By recovering critical raw materials from Li-ion batteries, manufacturers can shield themselves from supply disruptions and generate additional revenue streams.

References

- Finding life in retired EV

- End-of-life Electric Batteries: Recycling or Second-Life

- The Global Second-Life EV Batteries Market

- A case for the Circular Economy in Electric Vehicle Batteries

- A second life for disused modules and EV batteries

- MIT News (Solar energy farms could offer second life for EV batteries)

- The importance of second-life batteries for energy storage

- Second-life EV Batteries

- Second life: Carmakers and storage startups get serious about reusing batteries

Need a thought partner?

Share your focus area or question to engage with our Analysts through the Business Objectives service.

Submit My Business ObjectiveOur Clients

Our long-standing clients include some of the worlds leading brands and forward-thinking corporations.

- © 2021 Cheers Interactive (India) Private Limited. All rights reserved. FutureBridge ® is a registered trademark of Cheers Interactive (India) Private Limited.