Emerging LNG Markets and Role of Second Generation LNGCs

Energy

Energy

Present Market Scenario: LNG

Despite the increased focus on embracing cleaner sources of fuel, natural gas and oil continue to dominate the global energy mix. This trend will likely continue till 2040 according to the IEA’s Sustainable Development Scenario. The way energy is produced and distributed will be less fossil-fuel-intensive in the near future due to reduction in energy intensity across many developed and developing economies largely driven by stringent regulations, and energy efficiency initiatives. Of the most widely used fossil fuel sources, such as natural gas, coal, and oil, the demand for natural gas is expected to grow exponentially due to its acceptability as a cheap source of clean fuel. According to BP’s 2018 Energy Outlook report, global LNG supplies will double in number between 2016 and 2040, and more than 40% of this expansion is expected to take place over the next 5-6 years.

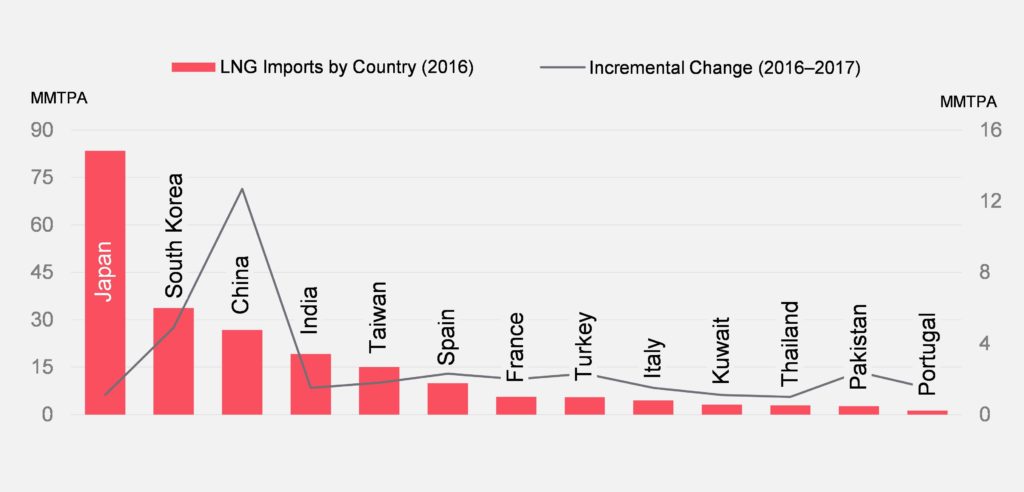

According to the International Gas Union, 2018 was a phenomenal year for global LNG trade, as volumes increased by 35.4 MMT y-o-y, accounting for 293.1 MMT in 2017. A majority of the overall demand for LNG originated from Asian importers, such as China and South Korea. Japan remains the largest importer in terms of absolute volume, with consumption levels reaching ~85 MMTPA in 2017. Qatar continues to dominate the market by supplying 81 MMTPA of LNG in 2017, followed by Australia (56.2 MMTPA) and Malaysia (26.4 MMTPA). Despite Qatar’s leading position as a dominant supplier for over a decade, its market share has dropped to under 30% over the last 2-3 years due to other exporters, such as Australia and the US increasing their production capacities. During 2017 and H1 2018, ~90% of the installed liquefaction capacity additions came from the US, Australia, and Russia.

Increase in new gas infrastructure, both, new plants and trains in the Pacific Basin, China, India, Pakistan, Egypt and Jordan, is expected to support the rise in gas trading. During 2017-22, the share of traded gas is expected to increase from 25% to 28%.

Source: IGU, 2018 World LNG Report

Several Asian countries are at different stages of implementing natural gas reforms; overall, this is expected to have a positive impact on the global LNG trade:

- Japan’s Fair Trade Commission (FTC) has ruled a clause that stops LNG buyers from reselling cargoes; it is also developing regional gas hubs to increase price visibility and promote spot trading

- South Korea plans to liberalize its gas markets completely by 2025, phasing its dependence on coal and nuclear; it is also thinking of introducing third party access rules, allowing private players to import LNG at their own terms

- Thailand’s Energy Regulatory Committee is evaluating market reforms in detail – it has already implemented third party access reforms

- Vietnam has published a policy goal to enable gas market prices to be set through competition

- In Malaysia the reform process is ongoing; it has introduced a third party access regime where private players utilize existing infrastructure to source short term supplies

- China has established a competitive mechanism for setting gas prices and has arranged for third-party access to LNG terminals; private players are encouraged to build new LNG import infrastructure; and, implementation of Blue Skies Policy

Energy Diversification

Over the last decade, several countries in emerging markets have joined the bandwagon for LNG (7 countries in 2010 to ~17 countries in 2017). This is primarily driven by the increasing need to:

- Secure and diversify the country’s energy security demands

- Address the shortfall in energy demand

- Replace carbon emitting fuels with cleaner sources of energy

On the demand-side, increase in new natural gas pipeline capacities in China, South Asia and Europe may exert some downward pressure on the LNG demand. However, industry experts claim that a debate on the timing of such an inflection point varies.

Around 128 MMTPA of projects have either been delayed or cancelled since 2015 due to reasons such as:

- Increased negotiating power of buyers due to surplus supply of LNG; buyers demanding more flexibility in contracts with short duration, high volumes, and accessible destination

- Cost and schedule overruns in Greenfield LNG projects

- Willingness of energy players to invest in short-cycle projects with capital flexibility

While oil and gas prices increased during the first 3 quarters of 2018, supply-demand mismatch and slow moving macroeconomics are shadowing any further price rise. Fluctuating oil prices have a direct impact on shipping companies, as these companies have invested billions of dollars in increasing their production capacities. Thus, to reduce the demand and supply gap, the oil and gas industry has shifted its focus to second generation LNG carriers, which are simpler, lightweight, and cost-efficient.

Modified hybrid propulsion LNG carriers (LNGCs) encompass the ability to monetize small-to-medium-sized stranded gas fields and cater to distant markets. Second generation LNGCs enable the deployment of an existing Floating Natural Gas (FLNG) vessel with capacity of ~1 MMTPA, which is suitable for a medium-to-small fields, thereby saving time and resources involved in conducting detailed feasibility. LNG carriers approach these FLNGs, and later, gas is transferred through specialized delivery systems.

2.Second Generation LNG Carriers (LNGCs) for the Fluctuating Market

A key focus of carrier developers has been on maximizing the size and reducing the fuel cost. However, recent shift in the volume range, fuel emission, cost, and other technical requirements has propelled the development of second generation LNGCs. Second generation LNGCs are mid-sized carriers with hybrid propulsion systems and enhanced hull structure for efficient transportation. The small size of these carriers makes them useful in accessing stranded gas reserves.

A significant number of small, stranded, and previously uneconomic gas fields exist globally. According to IEA estimates, nearly 40-60% of the world’s proven gas reserves are stranded, accounting for more than 1,200 fields. These fields could be classified into 4 subtypes, namely, associated gas reserves, deep offshore gas reserves, marginal gas fields, and remote gas reserves. New seismic and drilling technologies and innovative business models (financing, EPC contracting, etc.) have enabled the economic exploitation of these resources to ensure that the global supply will be able to address the increase in LNG demand over the next decade.

Traditionally, LNGCs were built for a “single project” (20 years of duration or project life). However, the present scenario suggests that there is a clear shift in LNG contracts, moving from integrated long-term contracts with fixed destination clause to flexible short-term contracts with flexible destination clause. In the past, owners were more in favor of locking-in their carriers for a longer duration to earn a stable and risk-free income. Conversely, at present, owners are undertaking risks that come with short-term contracts (cash in low price) to lock their vessels at the peak of market for shorter durations.

According to Poten & Partners (brokers and advisors), 30 out of 40 contracts that were tracked in 2017 were of duration >5 years. This trend of short-term contract makes the LNG market more flexible and results in LNGC owners and financers taking more market risks. Based on these factors, we expect that second generation LNGCs are most suited to address the tailor-made requirements of the oil and gas industry.

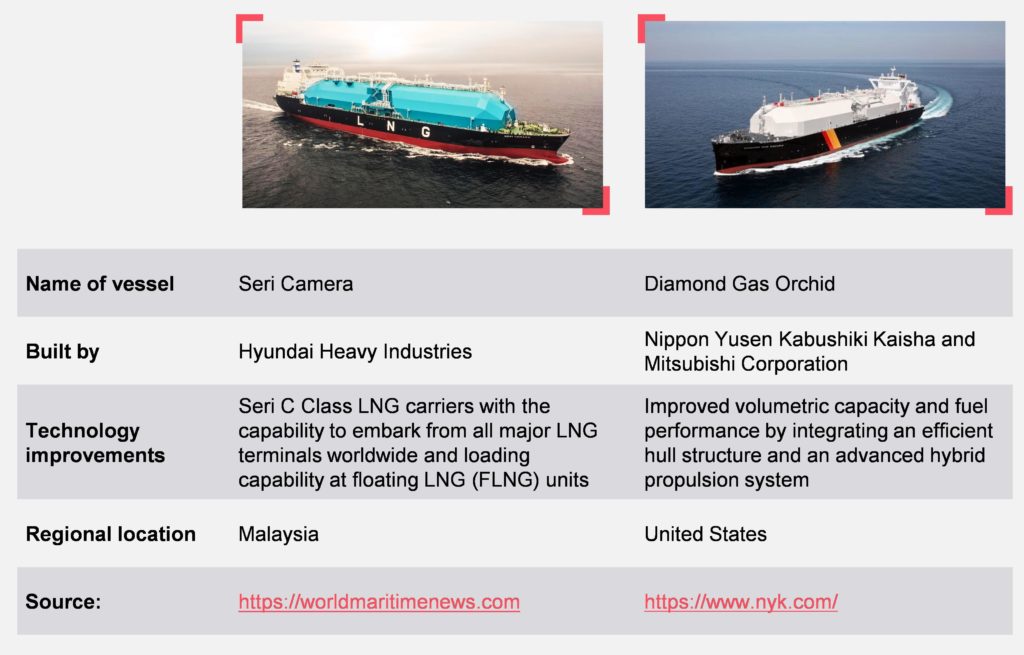

Case examples of second generation LNGCs are given below:

Major Technological Advancements in LNG Carriers (LNGCs)

Second generation LNG carriers not only has improved LNG carrying capacity, but also has superior fuel performance due to its advanced hull structure and hybrid propulsion system. These ships are not only expected to minimize emissions due to its efficient energy management systems, but will also present opportunities for using advanced digital technologies which can offer better return on investments due to less manpower, reduced downtime for maintenance, and, better interaction with their servers.

- Development of Continuous Steel Cover: Major focus of LNGC developers (past and present) has been on increasing the volume of cargo and reducing fuel consumption. Diamond Gas Orchid carrier, developed by a joint venture between Nippon Yusen Kabushiki Kaisha (NYK) and Mitsubishi Corporation, uses continuous steel cover that not only reduces ship weight but also minimizes air resistance. Therefore, such vessels can carry more LNG and save fuel by efficient transportation.

- Revamping LNGCs Propulsion Systems/Propulsion Technology: Due to strict emission regulations, LNG developers are focusing on new propulsion fuel to ensure cost savings. MAN Energy Solutions (Marine Engines and Systems) has developed a dual-fuel-two-stroke engine that enables LNG developers to choose the most economical fuel (conventional marine diesel oil or high pressure natural gas) to provide fuel flexibility and enhance efficiency. Moreover, LNG developers are opting for electric propulsion systems that function with/without diesel fuel.

- Reduced Cost of Building/Developing Gas Containment Systems: Gas containment systems (LNT A-BOX) developed by LNG New Technologies can be used to build mid-sized LNGCs for new/small shipyards. These systems help fill the gap between small LNGCs (Type C) and large LNGCs (larger membrane type).

- Digitalization of Carriers: Recently, DSME and DNV GL unveiled a new LNGC design that incorporates DSMEs Ship Internet of Things (SloT) technology, which assists in improved maintenance of carriers by automatically collecting data and providing enhanced cybersecurity.

Looking Ahead

Several countries are switching to natural gas for transportation (road/ marine), power generation, and other industrial usage. These application areas have the potential to modify the outlook of natural gas industry at a rapid pace. The cost advantage and flexibility of Floating Storage Regasification Units (FSRUs), economical LNG prices, and global initiatives on green fuel will boost LNG consumption. FutureBridge expect that this change in outlook will lead to a low demand for traditional LNG carriers and an increased demand for next-generation LNGCs. Moreover, we expect that conventional shipbuilders will have to relook at their existing strategies to tune their shop floors in a way that captures the changing business environment. As more and more small buyers integrate LNG in their energy mix portfolios, it is expected that demand for such carriers will likely increase in the next decade.

9 min read

9 min read