The fuel retail business has transformed due to a rise in demand for alternate fuels for mobility and the adoption of digital technologies in fueling stations. Customers nowadays, desire more convenience, speed, and security when purchasing fuel.

An increase in the number of Electric Vehicles (EVs) is propelling oil & gas players to modify their business models. Furthermore, advancements in technology and new consumer habits have fundamentally changed the traditional paradigms of fuel retailing.

In 2018, 2 million EVs were sold globally, taking the total tally to over 5.1 million EVs on the road, contributing to ~2% of the overall passenger vehicle sales in 2018. The sales were mostly concentrated in markets, such as the US, Europe, and China, which have the most constructive EV policies. According to Boston Consulting Group, the growth of EVs, autonomous vehicles, and advanced mobility solutions can possibly render 80% of the existing business-as-usual retail networks unprofitable within 15 years.

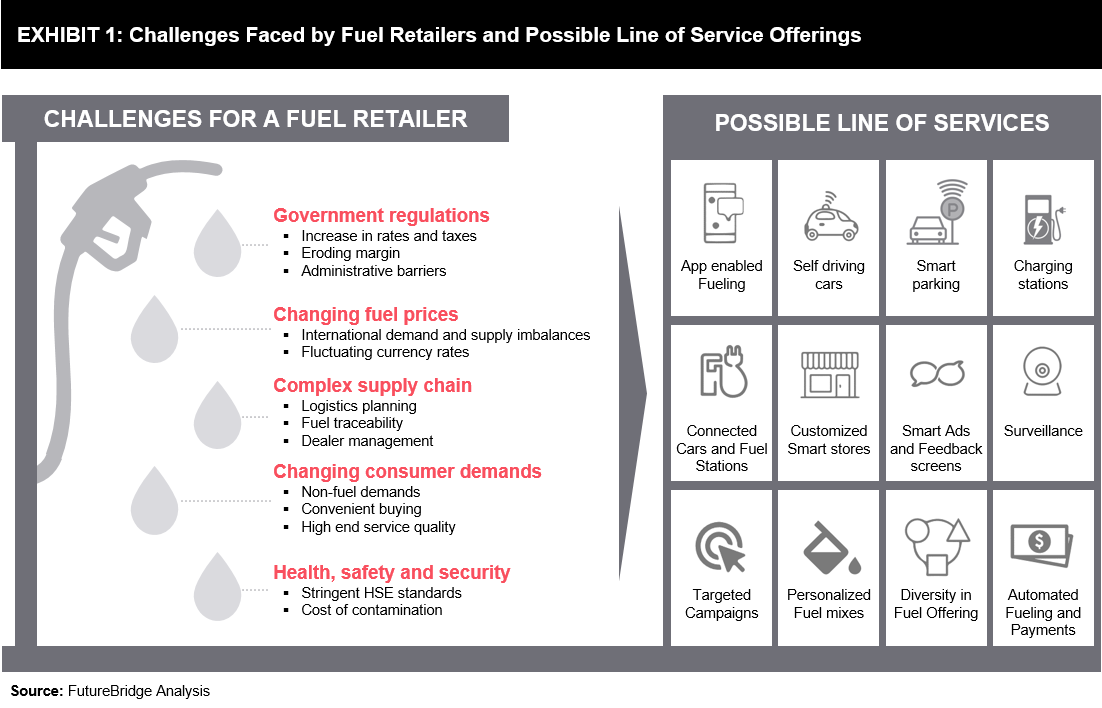

Fuel retailers need to respond to these trends transforming the automotive sector. They also need to move towards a customer-centric business model to capture new product and service opportunities, including the use of digital tools to extend the overall customer experience.

Digital technologies such as cashless payments have been adopted worldwide, reducing valuable customer time and increasing transaction security. Oil & gas companies are investing in research & development activities to study customer fueling patterns with an aim to improve customer service using Artificial Intelligence (AI) tools.

Fuel retailers are trying to transform their retail stations into one-stop points for customers, where they can purchase fuel and opt for vehicle servicing, along with grocery and food products purchase and other services at a single location.

Several innovations by fuel retailers are being witnessed across the globe. Non-fuel retail offerings, including cafes, shopping centers, ATMs, vehicle servicing, digital transactions, and automated and unmanned fuel stations, are being adopted by fuel retailers to increase their revenue. Fuel retailers are also utilizing analytics and AI to identify demand and usage patterns of customers, which will enable them to develop customized promotions for individual customers and sites.

Listed below are a few examples of such successful transformations.

Royal Dutch Shell

Royal Dutch Shell has a network of more than 44,000 retail stations in more than 75 countries. The company seeks to provide a safe and welcoming environment for its customers and service champions in all of its retail stations.

Shell’s TapUp service delivers fuel to customer cars at the touch of an app. Shell TapUp is a web-based application that allows consumers and businesses to conveniently schedule orders for fueling and other services for their vehicles. The service was tested in the Netherlands and has been rolled out globally. Drivers in Rotterdam can currently order fuel via their smartphones, specifying the time and location of the service. By leaving the fuel flap on their car unlocked, drivers do not need to be physically present while re-fueling.

Shell has been working on introducing a cloud-based, deep learning solution built on Microsoft Azure. This innovative new project, known as Video Analytics for Downstream Retail (VADR), is an effort by Shell to reduce risks at retail stations, while simultaneously increasing operational effectiveness and efficiency. It uses closed-circuit camera footage and Internet of Things (IoT) technology to automatically identify safety hazards and alert service champions, enabling them to quickly respond and eliminate potential problems.

The company also aims at offering premium or VIP services. Shell established two exclusive sites in Bangkok, selling the highest quality fuel, V-Power. In these centers, customers can enjoy a coffee served in a luxury café. Each customer is allocated two attendants, one for serving coffee and the other for servicing the vehicle.

In the alternate fuel space, the company is rolling out a number of experimental initiatives to introduce electric battery chargers and hydrogen chargers in the traditional petrol stations, to capture the market of non-combustion engines. Shell has plans to establish a ‘no petrol’ service station in London, the UK, which will offer biofuels, EV charge points, and hydrogen fuel retailing. The service station will also encompass a food court and provide Wi-Fi service for customers.

The company has plans to open retail stations and convenience stores in markets, including China, India, and Mexico. Furthermore, it plans to launch battery charging points and hydrogen fuel cell chargers in retail stations to enhance its market presence in the alternate fuels segment.

ExxonMobil

ExxonMobil’s research & development team is striving to identify innovative solutions for the changing preferences and needs of customers. ExxonMobil has been proactive in implementing various schemes and initiatives to enhance the customer experience in its fuel retail stations.

ExxonMobil, in association with major brands, such as AT&T, Macy’s Nationwide, Rite Aid, Direct Energy, Hulu, and American Express, launched Plenti coalition loyalty program in 2015. This program enabled customers to earn and redeem Plenti points at multiple brands.

In 2016, ExxonMobil introduced Speedpass+ mobile payment app (revamp of Speedpass mobile app). Customers can directly pay through the app for fuel and earn Plenti reward points. Speedpass+ mobile app enhances and simplifies payment at retail stations and can be integrated with a variety of connected vehicle platforms. ExxonMobil witnessed doubling of daily transaction volumes on the app in 2018. The company reports that app users purchase twice as much fuel on average as compared to customers who pay without the app.

ExxonMobil introduced Rewards+ loyalty program in 2018 that has been able to attract a large volume of new customers. The earned points can be redeemed for fuel purchase, car washes, and convenience store purchases at fuel retail stations. Rewards+ replaces Plenti loyalty program and is integrated with the Speedpass+ app.

ExxonMobil has recently launched its “Supremium” marketing campaign featuring the “Mr. Supremium” character, with TV, radio, and social media content. The company will also promote the new fuel in advertisements at its 2,500 Exxon- and Mobil-branded sites that have Gas Station TV, and through signage at the pumps and around the site for its entire 11,500-store network.

The on-demand economy is changing nearly every aspect of our everyday lives, including consumer expectations about the way fuels and lubricants are purchased, delivered, and used. ‒ Adam Wariner, Manager, Innovation Center of Excellence, ExxonMobil

ExxonMobil invested in on-demand vehicle car startup, Yoshi Inc., which supplies gasoline, oil changes, car washes, and other maintenance services to individual customers, corporates, and vehicle fleets. As part of this investment, ExxonMobil is to provide high-quality fuels (regular as well as premium) and lubricant products to Yoshi. The subscription-based service is currently available in Atlanta, Austin, Chicago, Los Angeles, Nashville, Silicon Valley, and the San Francisco Bay Area, with plans to expand the service to 25 major US cities in the near future. As quoted by Adam Wariner, Fuels and Lubricants Innovation Manager, “ExxonMobil believes the simplicity and convenience of direct-to-vehicle or on-demand care service will attract new customers to Exxon- and Mobil-branded products.”

China National Petroleum Corporation (CNPC)

CNPC operates 21,783 retail stations across China; 89% of these encompass an “uSmile” convenience store. Customers can purchase food, beverages, and auto supplies, as well as withdraw cash from ATMs, purchase lottery tickets, and pay mobile phone bills at these convenience stores. CNPC has evolved its business model from a traditional fuels supplier to “Gas station + Internet + Non-fuels,” i.e., a complete service station offering a wide range of services and goods.

In April 2019, CNPC rolled out the smart fueling station in Shanghai, which enables customers to fuel their vehicles without stepping out. CNPC plans to have 100 conventional fuel stations equipped with smart fueling, which will cut down fueling time from six minutes to approximately two minutes. Fuel stations will make use of IoT, cloud technology, and intelligent sensors to make fuel stations smarter.

CNPC Shanghai has included third-party payment platforms, such as WeChat, Alipay, and UnionPay, for fuel payment at its retail stations. This is the first instance of mobile payment service for fuel and non-fuel products in Shanghai. With the fuel market in China opening up to foreign players, CNPC is investing in the integration of digital technologies to maintain its dominance in the market.

A retail station in Chongqing operated by CNPC has installed electronic signboards on each refueling stand, which helps customers identify available refueling stands, thereby eliminating vehicle queues. The staff members have been issued a pair of special glasses that allow in completing payments within 30 seconds. After refueling the vehicle, the staff member scans customer’s license plate and informs about the money to be paid. The customer presents a QR code on his mobile phone, which gets scanned by the special glasses for completing the payment. This significantly reduces customer time, as customers can make payments without stepping out of their vehicles. The retail station team also plans to introduce a facial recognition technology to aid payment, which is currently under development.

MOL Group

MOL Group owns a network of nearly 2,000 service stations under six brands across nine countries in Central and Eastern Europe. MOL Group’s strategy is to transform its retail station network to a multi-purpose service station and to shift from a product-driven operation to a customer-driven operation.

MOL Group introduced a new convenience brand, Fresh Corner, to provide premium quality coffee, fresh food, and groceries to its customers. Currently, the MOL Group operates 700 Fresh Corner outlets with plans to expand to 1,250 outlets by 2021. The company also offers Fuel Cards to its customers, which can be used for cashless purchase of fuel and related products and services at any of their retail stations across 11 countries in Europe. MOL Group Cards also offer toll payment in most European countries, as well as VAT and excise duty refund for purchases abroad.

MOL Group has come up with a business lounge and dog wash at one of its fuel retail stations in Bratislava, Slovakia. The business lounge is open to renting by companies and individuals for meetings. Customers can also order non-fuel purchases, in addition to fuel purchase with payment from fuel cards.

The future of fuel stations

The fuel station of the future will be a lot more than just a place to refuel your vehicle. App-enabled on-demand fueling, alternate fuel offerings, electric charging points, mobile apps for multiple payment options, food arenas, automated fueling and analytics to track customer fueling patterns, and customized promotions are changing the dynamics of the fuel retail industry. Fuel retailers have been increasingly investing in such parameters to offer a unique experience to customers. Although growth in EVs and autonomous vehicles is expected to be exponential, majorly driven by developing economies in Asia and Africa, the transport sector will still be dominated by liquid fuels in the near future.

Need a thought partner?

Share your focus area or question to engage with our Analysts through the Business Objectives service.

Submit My Business ObjectiveOur Clients

Our long-standing clients include some of the worlds leading brands and forward-thinking corporations.

- © 2021 Cheers Interactive (India) Private Limited. All rights reserved. FutureBridge ® is a registered trademark of Cheers Interactive (India) Private Limited.